Understanding Private Debt

Understanding Private Debt

Private Debt (also known as private credit) has exploded in popularity over the last 15 years driven largely by interest from sophisticated institutional and ultra-high-net-worth (“UHNW”) investors searching for diversified investment opportunities characterized by stable, high-income yields.

As an investment strategy, private debt investments involve non-bank financial entities, such as private debt funds, lending money to (mostly) private companies in exchange for (primarily) interest payments.

The substantial growth of private debt is intricately linked to the 2007-2008 Global Financial Crisis. The crisis was caused, in large part, by large global banks engaging in high-risk financial activities, which came undone, wreaking substantial damage to the global economy.

In the wake of the crisis, banking regulators from around the world introduced new rules and regulations that constrained banks from engaging in high-risk financial activities going forward. Chief amongst these new constraints were elevated regulatory capital requirements applicable to bank lending activities.

As bank lending standards tightened, the availability of credit (or financing) shrank with the impact being felt by Private Equity firms looking to execute leveraged transactions as well as companies looking to borrow funds for a variety of reasons.

This prompted both private equity and a variety of companies to begin searching for new forms of financing leading to the substantial growth of the private debt industry.

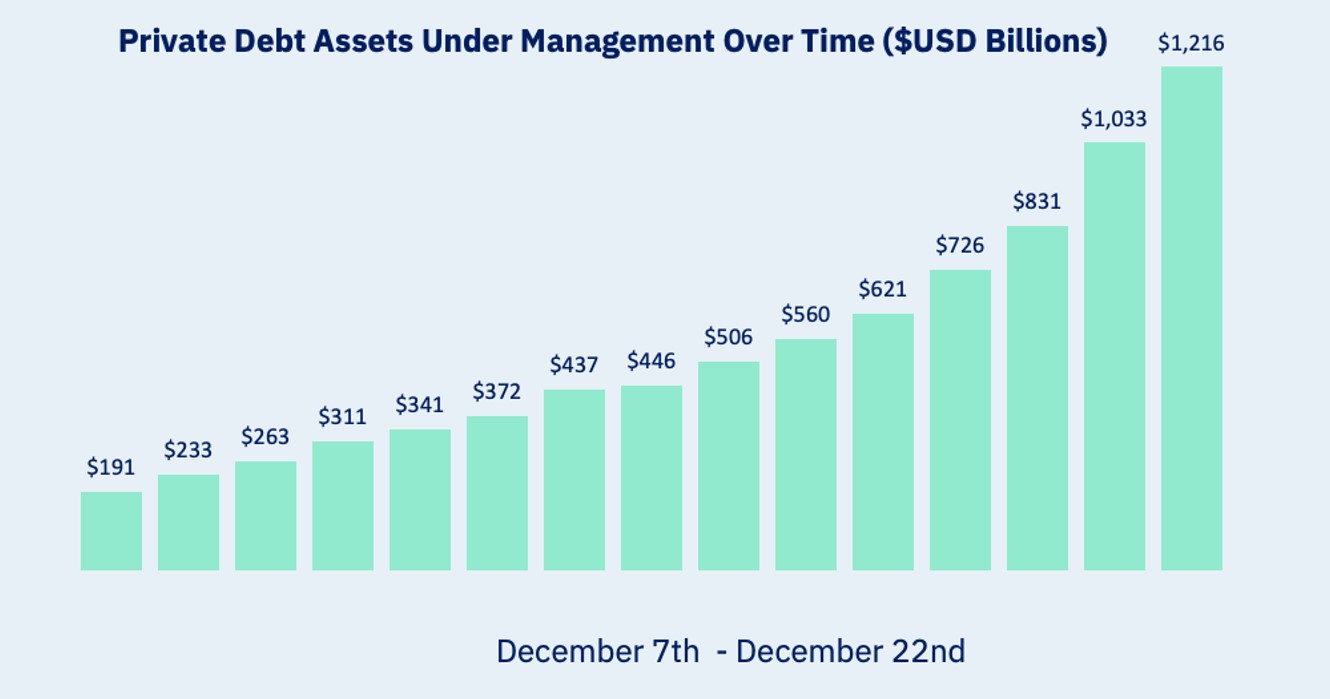

As of December 2022, Private Debt accounted for 12% of all private markets assets under management (AUM), totaling $1.5 Trillion USD growing by a compounded annual growth rate of 14.7% over the last 10 years.1

Below we illustrate the growth in Private Debt assets under management over time.

Exhibit 1: Private Debt Assets Under Management Over Time ($USD Billions)2

Private Debt is an an asset class that includes a wide variety distinct sub-asset classes that produce varying risk and return profiles. For the remainder of this article, we focus on the largest sub-category of Private Debt, which is known as Direct Lending.

What’s So Great About Private Debt?

According to research from the CAIA Association, Direct Lending Private Debt has historically produced higher absolute and risk-adjusted returns when compared to bonds and traded loans.3

The higher relative performance reflects several factors that separate Direct Lending from high yield bonds and traded loans. The factors include the structural illiquidity of private markets, the premium associated with direct lending transaction structure flexibility and speed as well as the supply/demand dynamic inherent in the direct lending industry where lenders have greater pricing power when structuring lending arrangements.

From a risk perspective, direct lending, which is typically secured lending, has historically seen lower default rates and higher recovery ratios relative to high yield bonds. Below, we compare the characteristics of direct lending versus High Yield and Investment Grade Credit.

Exhibit 2: Comparing Direct Lending to High Yield & Investment Grade Credit4

| Feature | Direct Lending | High Yield | Investment Grade |

|---|---|---|---|

| Market | Private | Public | Public |

| Floating Rate | Yes | No | No |

| Secured | Yes | No | No |

| Liquidity | Limited | Conditional | Conditional |

| Duration | 0.25 | 4.14 | 7.07 |

| Historical Loss Rates | 0.7% | 1.8% | 0.1% |

| Current Max. Drawdown | 0% | -14% | -17% |

| GFC1 Max. Drawdown | -8% | -28% | -9% |

| Annualized Volatility | 3.7% | 9.5% | 6.2% |

| Annualized Return | 9.3% | 5.7% | 4.4% |

| Current Yield | 11.4% | 9.1% | 5.4% |

| Current Coupon | 11.1% | 5.8% | 3.7% |

| Current with DL | 1 | 0.44 | 0.12 |

Until quite recently, bonds had not provided investors with a substantive enough yield on their capital and Private Debt was seen as an alternative which could help bond investors find yield in an era of low interest rates. However, with interest rates rising, traditional bonds have regained attractiveness as safe, yield generating investments.

Today, Private Debt continues to offer investors attractive risk adjusted returns relative to both traditional credit investments as well as public and private equity.

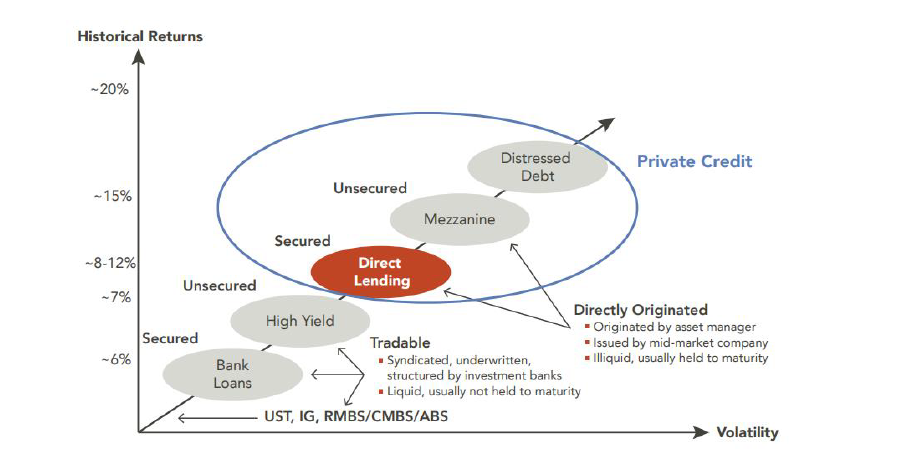

As we mentioned earlier in this article, there are many different types of private debt strategies. Below we showcase a chart from Marquette Associates that highlights the different types of private debt strategies and their respective historical risk & return characteristics.

Exhibit 3: Private Debt Breakdown and Risk/ Return Profiles5

What is Direct Lending?

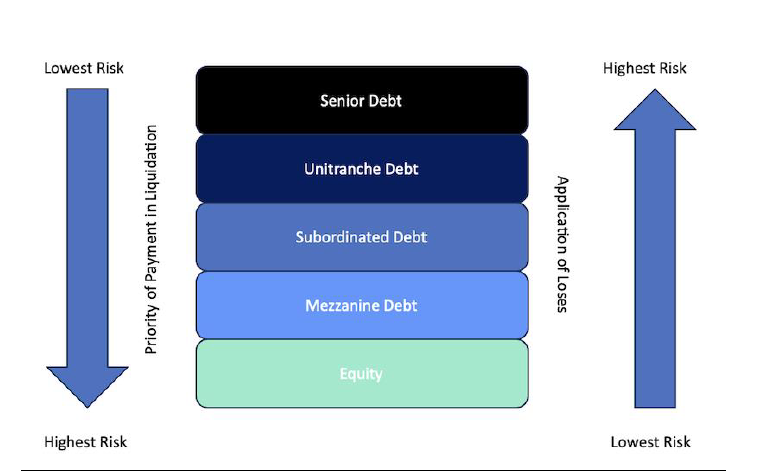

Direct Lending investment funds are private market funds that raise money with an aim to lend the capital directly to private and public companies. Unlike other subsegments of Private Debt, Direct Lending transactions reside at the high end of borrower capital structures and are usually secured against borrower assets. In the event a borrower defaults on their direct lending loan obligation, the direct lender usually has multiple recourse options and repayment priority over other borrower creditors.

Like all types of debt investments, the risk and return profile of Direct Lending depends on where the loan ends up fitting in the borrower’s capital structure, the terms of the individual loan, the borrower’s overall finances and how much debt they have in total. Below we showcase an illustrative capital structure in order of priority. Senior secured direct lending transactions often occupy the top end of a given borrower’s capital structure usually only junior to any bank debt a borrower may have.

Exhibit 4: Direct Lending Structure6

The investment characteristics that underlie most Direct Lending loans include:

- Floating interest rates

- Shorter maturities

- Strong loan terms and restrictions (covenants)

- Inability to access invested funds (illiquidity)

- Low correlations with public markets because of the customized nature of the loans

How To Invest in Direct Lending

Direct Lending investing involves purchasing individual private loans or shares of a Private Debt fund. Like Private Equity, Private Debt funds can be either Closed Ended (investor money is locked up) or Open Ended (Investors have some sort of liquidity within a certain time period). Large investment firms like Apollo, Oaktree and Neuberger Berman are prominent Direct Lenders.

As the Private Debt industry has matured and grown in scale, retail/private wealth access to high quality Private Debt funds has increased.

Why Invest in Direct Lending

Diversification

Direct Lending investments are structured differently than traditional fixed income, typically carry floating interest rates and shorter maturities. They are not as impacted by interest rates as fixed rate debt. As such, Direct Lending strategies have a lower likelihood of declining in value as interest rates rise because of these floating-rates and lower maturities. This counterbalancing (duration mitigation) and the bespoke nature of investments at the loan level adds diversification.

Higher Income and Returns Potential

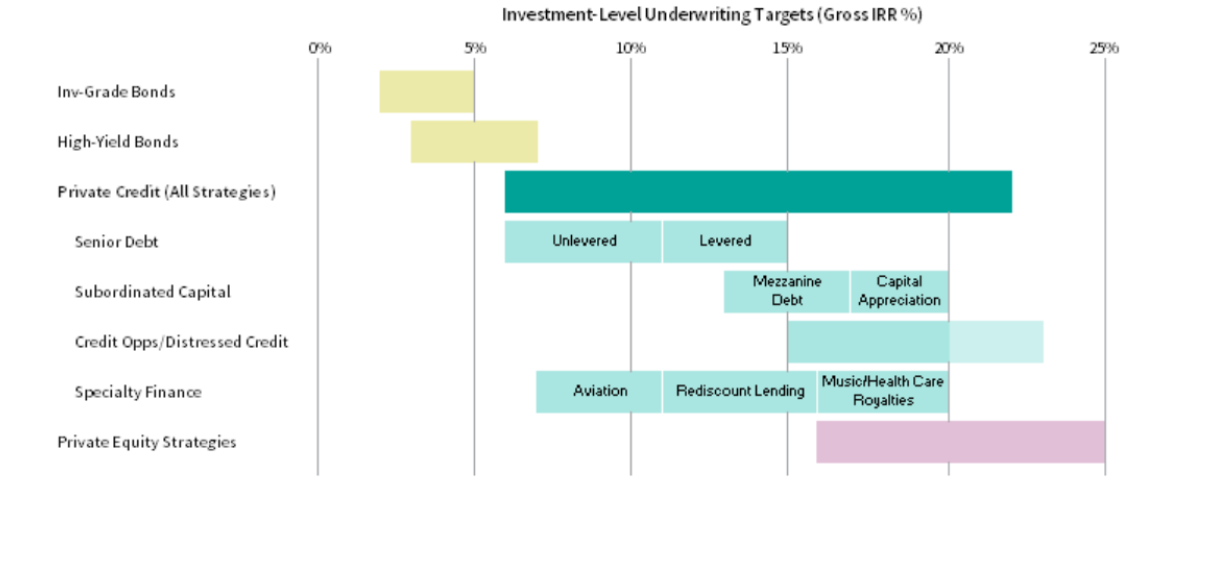

Direct Lending often offers higher income compared to traditional bonds. Direct Lending can also come with investment “sweeteners” like warrants or provisions that convert a debt holder’s position to equity.

This gives investors a bond-like risk profile with equity-like returns. Before fees, Direct Lending can generate between a 6% – 20% annualized return. This is a far cry from what traditional bondholders can earn.

Exhibit 5: Private Debt Returns Spectrum7

Volatility Reduction

Since Direct Lending investments are illiquid and not valued daily (typically priced monthly or quarterly), they have less price volatility compared to traditional fixed income securities that are priced daily. This makes them more attractive on a pure risk adjusted basis.

Risks and Considerations

A key risk with Direct Lending is borrower default. If a borrower cannot repay the loan, the investor may lose some or all their investment.

Additionally, illiquidity and individual loan transparency can present challenges for investors. Most Direct Lending funds have lock up periods and restrict one’s ability to get their money out in a pinch. The fund managers also do not get the individual loans in their portfolios rated by credit rating agencies like S&P or Moody’s, so it is hard to determine individual loan quality from a third-party source.

Furthermore, Direct Lending funds suffer from unique loan level deal structuring and due diligence risks. While Direct Lending funds invest in multiple loans, fund managers without specific expertise or who lack flexibility to adapt to individual borrowers’ needs create fund level investment risk. That is why choosing a manager with a long track record is critical.

The rise of Direct Lending has created a competitive industry for fund managers. Sourcing high quality individual loans has become difficult, and managers must establish a strong origination network to offer high quality investment opportunities backed by loans with strong covenants. The state of Direct Lending origination makes it even more important to be careful when it comes to the manager you chose to invest with. Make sure they have a good reputation and track record of success.

Lastly, Direct Lending funds come with a Private Equity like fee structure which can eat into returns. Direct Lending funds established between 1987 and 2023, charged a median management fee of 1.75%, carried interest of 20% and had a preferred return hurdle rate of 8%. This means that in addition to the 1.75% management fee, the fund manager is entitled to 20% of funds’ returns that exceed an 8% threshold8.

1 Preqin as of December 2022.

2Preqin as of December 2022.

3CAIA Association – “Why Direct Lending?” as of January 2022.

4StepStone Group, “Relative Attractiveness of Direct Lending: Term and Credit Risk,” as of February 2023.

5Marquette Associates, “Investment Perspectives – Supercharged Fixed Income – Direct Lending,” as of October 2016.

6Preqin, “What is Private Debt.”

7Cambridge Associates, “Private Credit Strategies: An Introduction,” as of September 2017.

8Preqin.