Let’s Get Real

Alternative Investments for Inflationary Times

Disclaimer: This article is only intended to provide you with general information. It is neither an offer to sell nor a solicitation of an offer to purchase any security and does not constitute, and should not be construed as, investment advice. Any statement about a particular investment or company is not an endorsement or recommendation to buy or sell any such security. The article is not intended to provide legal, accounting, financial or tax advice, and should not be relied upon in that regard. You are encouraged to seek independent advice. Every effort has been made to ensure that the article is accurate as of the date of first publication; however, we cannot guarantee that it is accurate, complete, or current at all times. The article may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

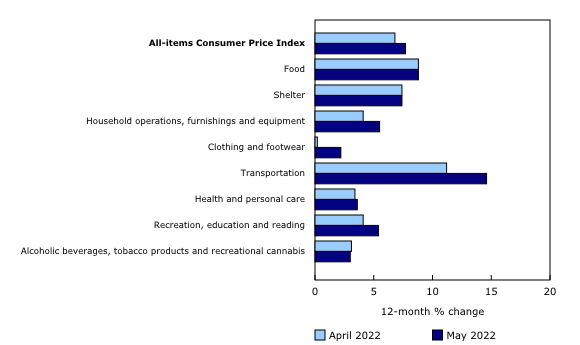

This past Sunday, my wife and I had some friends over for lunch. On the menu was overnight braised beef short ribs served with a side of crispy purple cabbage and seasoned rice, all courtesy of my wonderful and extremely talented wife. As we caught up with our friends, the conversation turned to the increasing cost of food, highlighted by a $3.50 onion that our friend had recently purchased at Loblaws. Sticker shock aside, inflation in Canada has gotten to levels not seen in many decades. As of May 2022, the Consumer Price Index (CPI) topped 7% on a year over year basis, crossing the January 1991 read of 6.9% (source: Statistics Canada). The lingering impact of the pandemic combined with structural market changes (e.g. the move away from fossil fuels) has resulted in a persistent, high inflation market environment that has and will continue to impact many facets of life, including how investment portfolios perform.

What is the Consumer Price Index or CPI? The CPI aggregates price data (over time) across a broad basket of goods and services in order to construct a view of month over month and year over year changes to the cost of living for Canadians. The CPI basket is comprised of food, shelter, transportation, leisure, and other goods and services, that make up the vast majority of living expenses.

So how does inflation impact investment portfolios and what kinds of investments offer protection against inflation? Before exploring these questions, I want to highlight one key definition:

Nominal versus Real Investment Returns: When you look at the performance of your investments, you are looking at nominal returns. These are investment returns that do not take into consideration the impact of inflation. Real returns, on the other hand, are investment returns after inflation has been deducted. Lets consider an example. Say your portfolio generated a 10% return from May 2021 to May 2022. As noted above, inflation, as measured by the CPI, increased by 7.7% over the same period. So your nominal return would be 10% while your real return would be 10% minus 7.7% or 2.3%.

The Impact of Inflation on Investment Portfolios

Why do you invest? What goal or objective are you trying to achieve? Whether its income, growth, capital preservation, or something else, whatever objective you are trying to achieve is compromised if the cost of living is increasing faster than the value of your investment portfolio. Said another way, if your investment portfolio isn’t increasing in value at a rate greater than inflation, your investment portfolio is failing at its fundamental purpose. This in a nutshell is the impact of inflation on investment portfolios. The higher the rate of inflation, the higher your portfolio returns need to be to protect and ultimately grow the real value of your capital.

In Canada, long term inflation has typically fallen within the 1%-3% range. This kind of inflation is called ‘expected’ inflation and is largely baked into economic activity (your annual salary cost of living adjustment or COLA would be an example). Expected inflation is priced into the future costs of goods and services, so things like company revenues and profits are not substantially impacted by it. In fact, expected inflation is combated quite well by owning a diversified portfolio of stocks as most publicly listed companies are able to adjust their prices to account for expected inflation over time. However, in times of uncertainty, expected and realized inflation can deviate creating ‘unexpected’ inflation. This is the dangerous kind of inflation that can erode the real value of investment portfolios and an environment in which stocks may not necessarily provide protection. For professional investors, it’s critical to be able to assess and tactically plan for periods where inflation may deviate from expectations. However, the reality is that unexpected inflation is almost impossible to predict making it difficult to plan for and deploy tactical adjustments to portfolios. The prudent approach, therefore, is to reinforce your portfolio with investments that can combat unexpected and high inflation when it occurs, while also generating reasonable returns when inflation is within normal ranges.

This brings us to real assets.

Real Assets

In the midst of the pandemic, I began day dreaming about owning a farm. Living in downtown Toronto in an apartment surrounded by condo construction, I was desperate for space and began visualizing myself as a farmer working the land. It didn’t take long to reconsider my far fetched fantasy but the idea of having a stake in an essential asset like farmland ended up sticking.

Farmland is an example of a real asset. Real assets are tangible, physical assets that are used in the production of goods and services consumed by individuals and businesses across the world. Real assets as a category of investments typically include asset classes such as real estate, infrastructure, and natural resources.

Real assets are usually considered for portfolio inclusion for the following reasons:

- Inflation protection

- Income

- Diversification

- Risk-adjusted returns

- Potential for capital appreciation

The intuition behind real assets as a means to protect against inflation is relatively straightforward. Real assets typically underpin essential goods and services, which are needed for survival. No matter what the stock market is doing, we still need food and water to survive, we still need energy to power our homes or transportation, and we still need all kinds of commodities to underpin the everyday essentials we rely on. What this means, particularly in the short term, is that the demand for real assets is usually stable and predictable and the prices of real assets can be adjusted to account for inflation without impacting short term demand. As a result, real assets like farmland are able to deliver relatively stable performance (net of inflation) in a variety of market environments. The remainder of today’s post will dive deeper on three real asset investments; farmland, timberland and infrastructure.

Farmland Investing

Farmland may fall into the ‘alternative’ investments bucket but it’s far from an alternative investment. Farmland investing predates any formal investment market by thousands of years. However, throughout the vast majority of history, the ability to access farmland as an investable asset class was virtually non-existent to anyone not directly tied into the farming industry. Farmland has historically been a fragmented, often family owned affair, requiring substantial expertise and long time horizons to extract value. These characteristics have begun to evolve as the ‘financialization’ of farmland has occurred over the last few decades. Today, investors can access farmland through publicly listed companies, investment funds and, most recently, fractional direct ownership of farmland through fintech platforms like FarmTogether or AcreTrader.

Farmland as an investment possesses a few key attributes:

- Income drawn from the sale of farm production

- Capital appreciation from the increase in the value of the land

- Diversification when held alongside stocks and bonds

- Protection against inflation

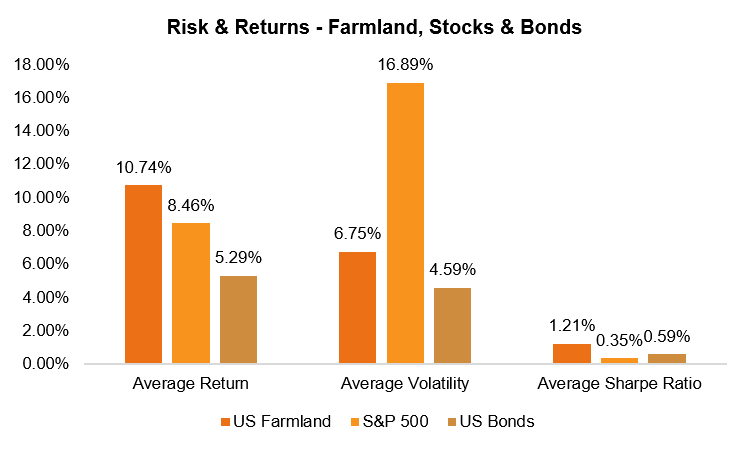

These attributes make investing in farmland an attractive proposition. Not just when inflation is high but as a strategic, long term portfolio allocation. Let’s look at some historical data.

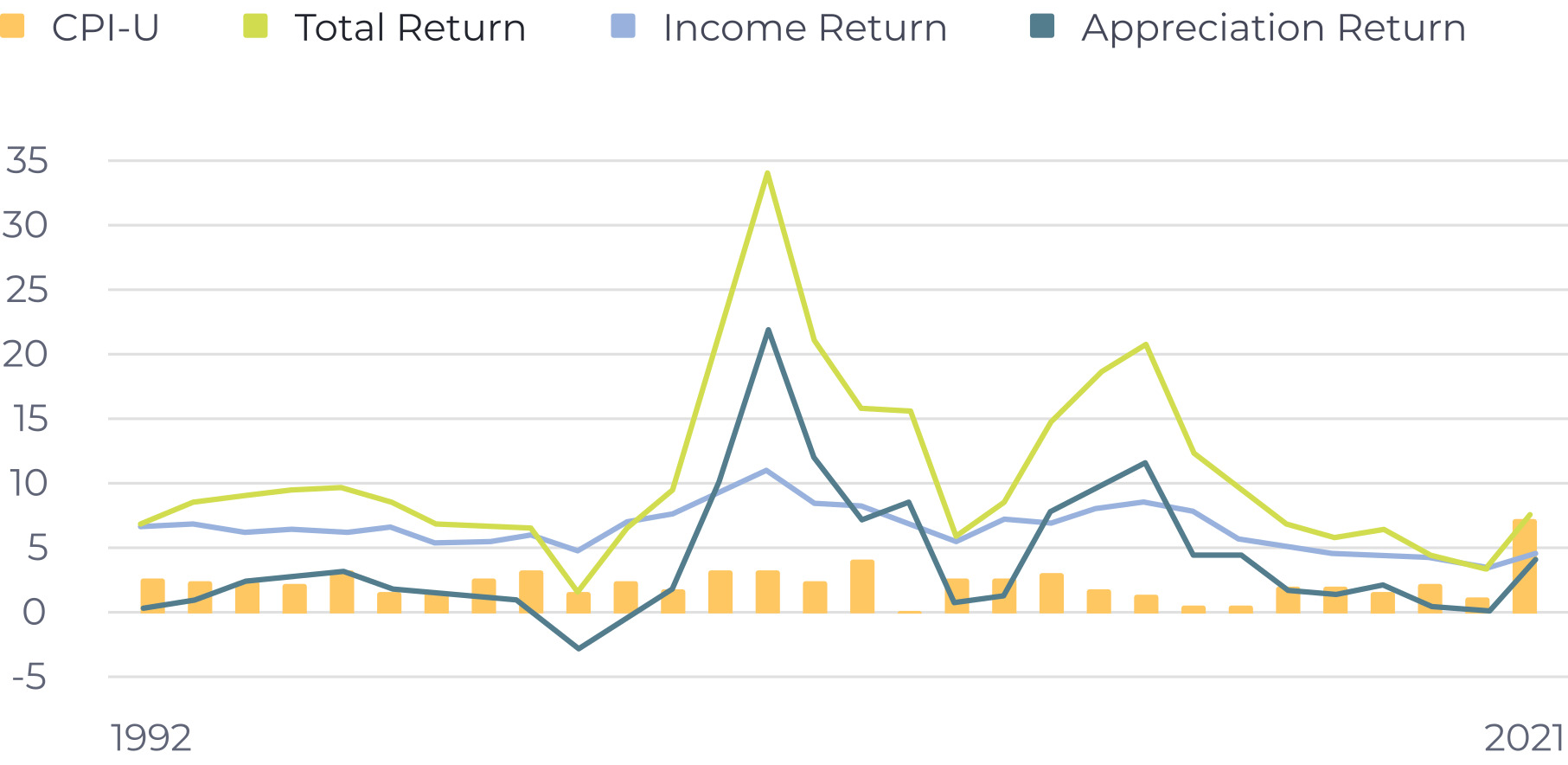

Clearly, farmland has more than held its own versus US stocks over the past 30 years. However, how does it track against inflation? The chart below breaks down the returns of US farmland into its component parts and plots it against US CPI-Urban, an indication of price inflation for urban consumers in the US. US farmland has consistently produced a positive return that has been more than double the rate of inflation since 1992.

Finally, farmland benefits from ongoing demographic changes across the world. Population growth, a rising middle class and a finite amount of arable land, all combine together to create long term tailwinds for farmland investing.

Timberland Investing

Timberland as an asset class can be broadly defined as the use of land to grow trees in order to harvest and utilize the wood (primarily). The wood harvested from timberland is used in all kind of things, including production of paper, building materials, furniture, packaging materials, etc. More recently, the increasing importance and focus on green house gas (GSG) emissions reduction/capture have created a new revenue stream for timberland. Companies and individuals are paying timberland owners not to harvest their trees so that the trees can capture and store carbon emissions. This has in essence turned some parts of timberland investing into a form of sustainable investing.

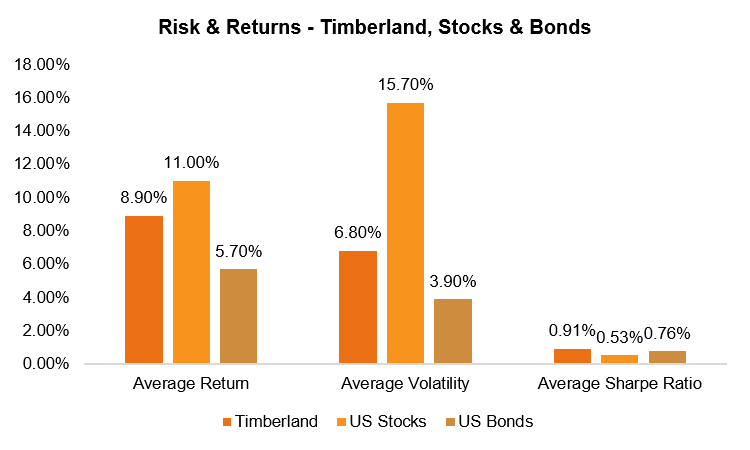

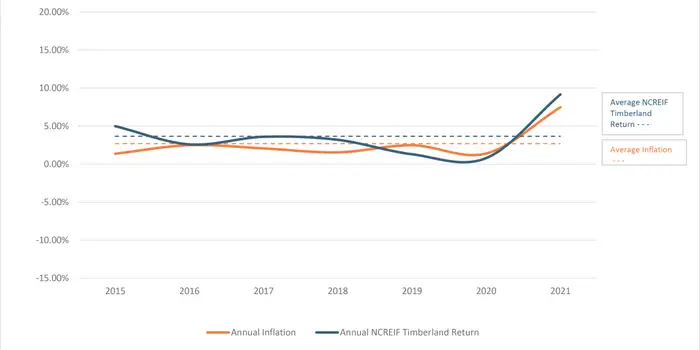

Similar to farmland investing, timberland investing is a relatively stable hedge against inflation while also producing returns in the form of income (primary) and capital appreciation (secondary). Importantly, performance of timberland investments have very little correlation with performance of stock and bond markets, making it attractive as a source of diversification.

While timberland returns have fallen short of US stock returns over time, the fact that timberland as an asset class has limited correlation to stock markets, while being positively correlated to inflation, makes it an attractive asset class to consider for a long term strategic portfolio allocation.

The demand for wood based products continues to be the primary driver of long term timberland returns, however, with the ongoing growth of the carbon credit market, timberland is set to experience positive tailwinds for years to come. Similar to farmland, retail investors are able to access timberland investments through publicly listed companies and investment funds. However, the many attractive opportunities to invest directly into timberland remain hard to access for most retail investors due to high minimum investment requirements and lack of liquidity.

Infrastructure Investing

The world of infrastructure investing is substantially larger and more diverse than both farmland and timberland investing. According to alternative investments advisor and fund manager, Cliffwater, infrastructure represents “the basic physical systems required to allow a business community, or nation to function.” Things like airports, seaports, railways and utilities (energy, communications) are all examples of infrastructure that can be accessed via debt or equity investment opportunities. While infrastructure investments span a variety of industries, sectors and geographies, they possess common investment attributes including:

- High barriers to entry

- Relatively inelastic demand

- Resilience to economic cycles

- Long duration

- Relatively stable and predictable cash flows

- Positive correlation to inflation

(Source: The Allocators Edge by Phil Huber)

More recently, with the ongoing digitization of global economies, infrastructure tied to digital services is an increasingly important category of the infrastructure asset class and investment opportunities that provide exposure to digital infrastructure continue to grow. Infrastructure returns depend on the type of infrastructure project as well as the stage of the project. For retail investors, who can only access infrastructure via publicly listed companies or funds that invest in publicly listed companies, historical returns for infrastructure are in the high single digits with low teen volatility.

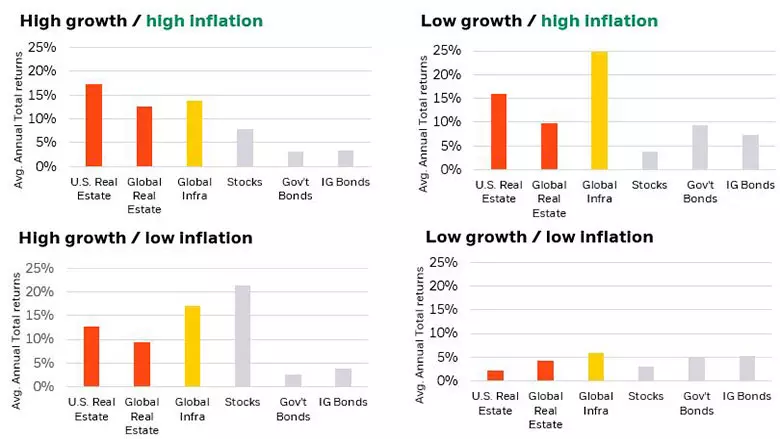

With respect to inflation, infrastructure has proven to be resilient in various inflation environments. Research from Blackrock highlights this fact in the illustration below:

Infrastructure investing is likely to continue to be an attractive and stable asset class for investors moving forward. Spending on infrastructure related projects around the world remains substantial and is only expected to increase.

To wrap up, real assets, as a category of investments, offer investors both short- and long-term benefits as strategic allocations in portfolios. Unlike most inflation sensitive investments (think inflation linked bonds or inflation sensitive commodities), real assets are able to provide value not just when inflation is high, but in most market environments.