Understanding Private Equity

Understanding Private Equity

Private Equity (“PE”) is the largest segment of the alternative investments industry. It makes up 64% of private markets assets under management (AUM), totaling $7.8 Trillion USD as of December 20221.

As an investment strategy, PE primarily involves investing in private companies with the goal of helping them grow, or increase their value. The objective of every PE investor is to try and sell their stake in the company they invested in for far more than they paid.

Leading PE managers like Blackstone, KKR, CVC and TPG have historically focused on raising money from sophisticated investors like pension funds, ultra-high-net-worth (“UHNW”) families, and sovereign wealth funds, but the industry is rapidly evolving to enable wealth advisors and individual investors to participate in this alternative asset class.

What’s So Great About Private Equity?

Private equity, as an asset class, has delivered strong performance for investors for close to three decades (more on this later). This strong performance has in turn seen more and more investors allocating investment capital to private equity, which in turn has created a fundamental change to global capital markets and global capital formation.

Today, private companies vastly outnumber publicly traded companies and increasingly, private companies are choosing to stay private longer, creating greater value for investors who have access to private equity versus investors who can only access companies when they are publicly listed. Below we capture a few data points to highlights these significant trends:

1.Private companies are choosing to stay private longer.

- According to research published by NASDAQ, in 1980, the median age of a company at its initial public offering (“IPO”) or the point at which a private company becomes publicly listed, was 6 years2.

- In 2021, the median age of a company at IPO was 11 years, nearly double that of the 1980 number.

- Additionally, in 1980, the median market value of a company at its IPO (adjusted for inflation) was $105 Million USD versus $1.33 Billion USD in 2021.

2.The number of private companies vastly outnumbers the number of publicly listed companies.

- According to research from Capital IQ as referenced by Hamilton Lane, 87% of US Companies with > $100M in annual revenue are privately held3.

- Said another way, there are 18,000+ private businesses in the US with > $100M in annual revenue versus 2,800 public companies with > $100M in revenue.

All said, investing in private equity allows investors access to large swaths of the global economy that they may not otherwise be able to access if they limit themselves to investing in public markets.

There are several categories of Private Equity including Venture Capital, Growth Equity and Buyouts but Buyouts are the largest and oldest segment of the space and the focus of the following sections of this article.

What is a Private Equity Buyout?

In a PE buyout, a PE investment manager (also known as a general partner or GP) acquires a controlling stake in a company with the intent of increasing its value through operational modifications such as management changes, strategy adjustments, cost cutting measures and more.

Buyouts gained popularity in the 1970s with the founding of KKR, one of the original private equity firms, and became mainstream in the 1980s. Many of today’s largest PE firms started with buyouts.

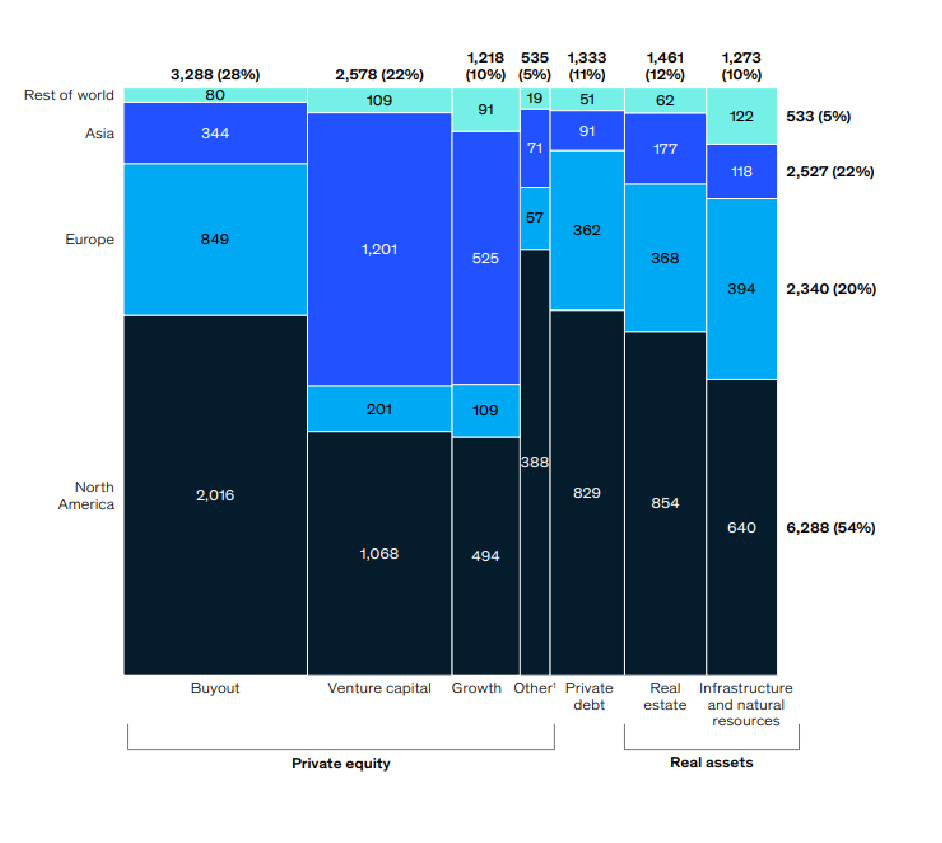

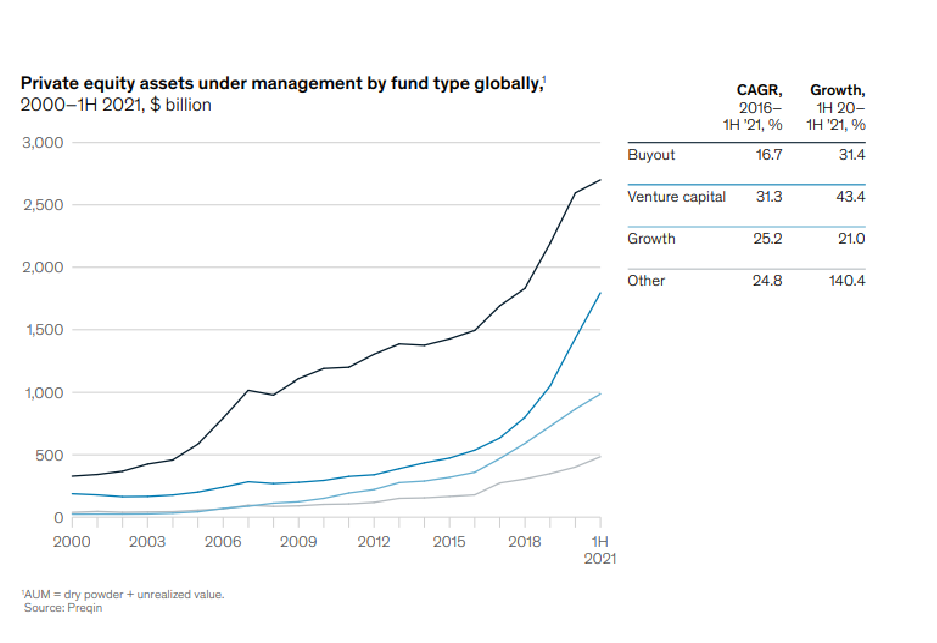

As at the end of the first half of 2022 buyouts totaled 28% of all alternative assets under management (AUM) and grew at a 16.7% CAGR between 2016 and 2021.4

Exhibit 1: Private Equity Buyouts % of Alternative Assets5

Exhibit 2: Private Equity Buyouts % of Alternative Assets6

There are several buyout strategies but Leveraged Buyouts (LBOs) are most common. Leverage buyouts entail the use of a combination of borrowed funds (debt capital) and investment funds (equity capital) to finance the buyout transaction.

How Do These Private Equity Investments Work?

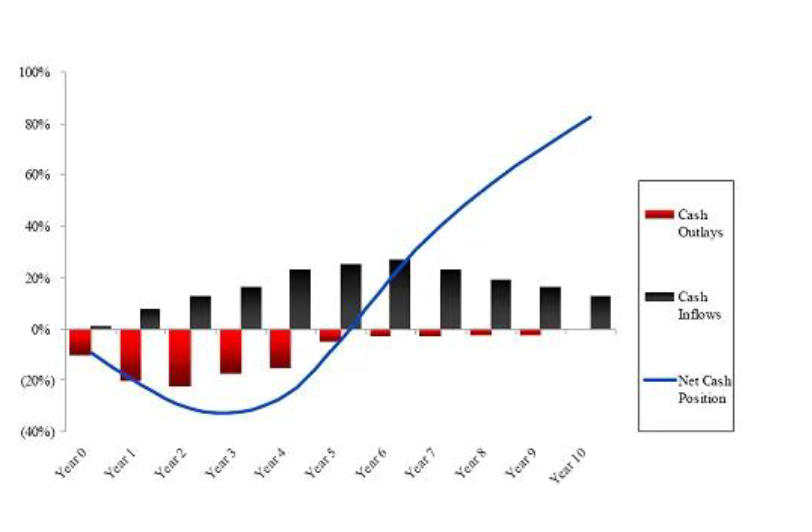

Traditional buyouts are facilitated through ‘buyout funds’ that lock up investor money (Limited Partners) for 10-15 years. These types of funds are referred to as closed-end funds. While closed-end funds have been the fund structure of choice for most PE managers for years, recent innovations in fund structuring have led to the offering of open-ended buyout funds that provide investors with liquidity within a certain timeframe.

Today, some of the world’s largest and most well-respected private equity investment firms have begun offering open-ended fund structures that share similarities with traditional closed- end funds but also the more familiar mutual fund structure where investors can contribute capital on a regular basis and can redeem their investment typically on a quarterly basis.

Exhibit 3: “Traditional” Buyout Fund Capital Deployment Model – “J Curve”7

The private equity investment manager is responsible for finding attractive investment opportunities and structuring deals to maximize returns. For leveraged buyouts, these investments involve large amounts of debt secured against the investment target’s assets or cash flows. Typically speaking, companies that are usually targeted for a private equity buyout are mature, profitable businesses that have stable cashflows.

After making a controlling stake investment, the private equity investment manager works with the acquired company’s management team and board to improve company financial performance and growth prospects. Over time, the acquired company looks to pay down the debt the private equity investment manager used in part to make their investment and the private equity investment manager tries to sell the company for more than they paid.

This use of debt, improvements in the acquired company’s performance and valuation upticks represent the return drivers for buyout private equity transactions.

How Will Exposure to Private Equity Buyouts Benefit My Portfolio?

Institutional investors have been investing in buyouts funds for decades and their characteristics can benefit private wealth.

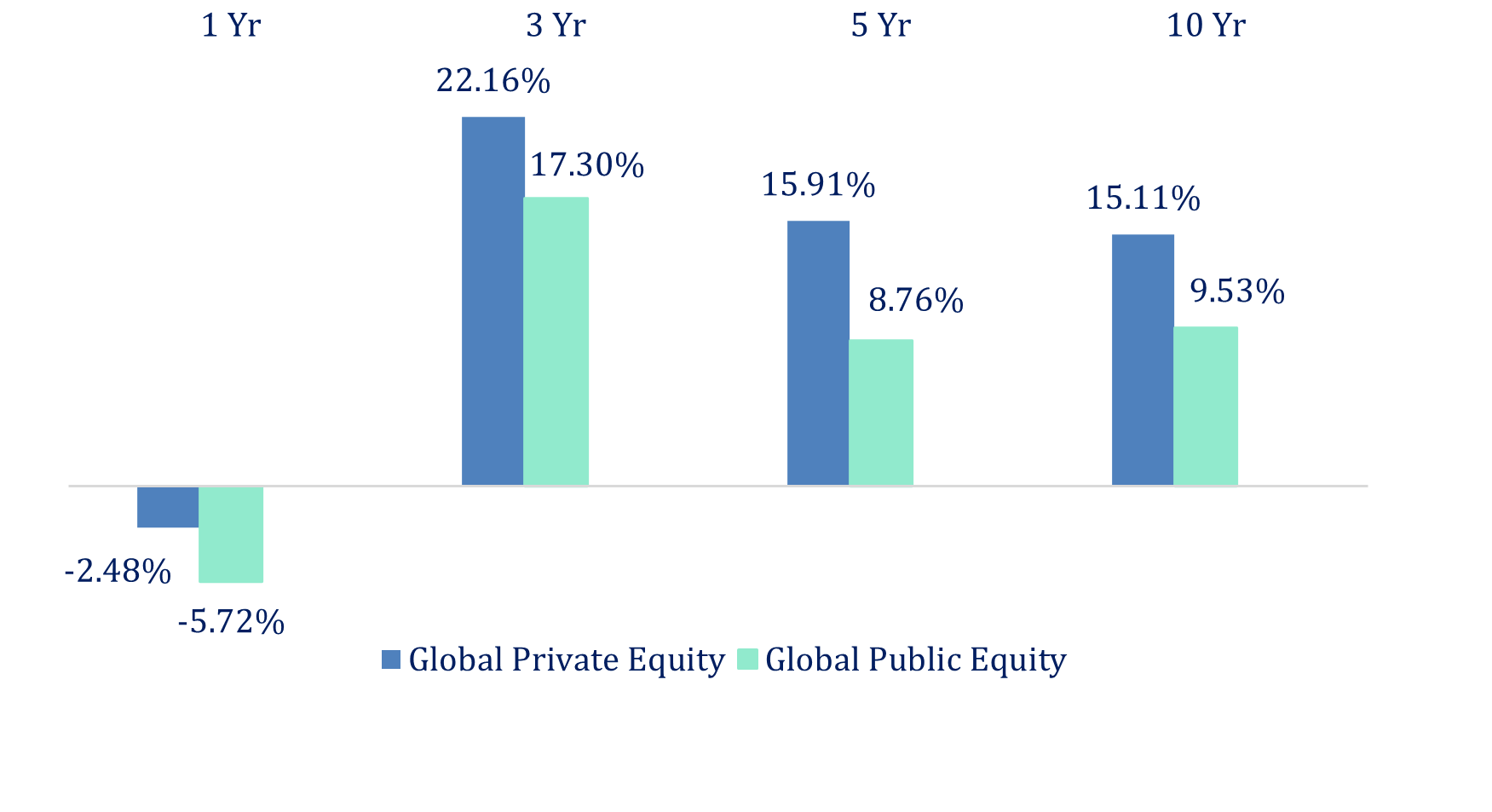

Higher Returns

As buyout funds are the largest PE asset class, we illustrate their historical performance by using the performance data of all private equity funds with data from Preqin. Over the last 10 years, private equity as an asset class has outperformed global public equities by 5.58%.

Exhibit 4: Global Private Equity Returns versus Global Public Equity Returns8

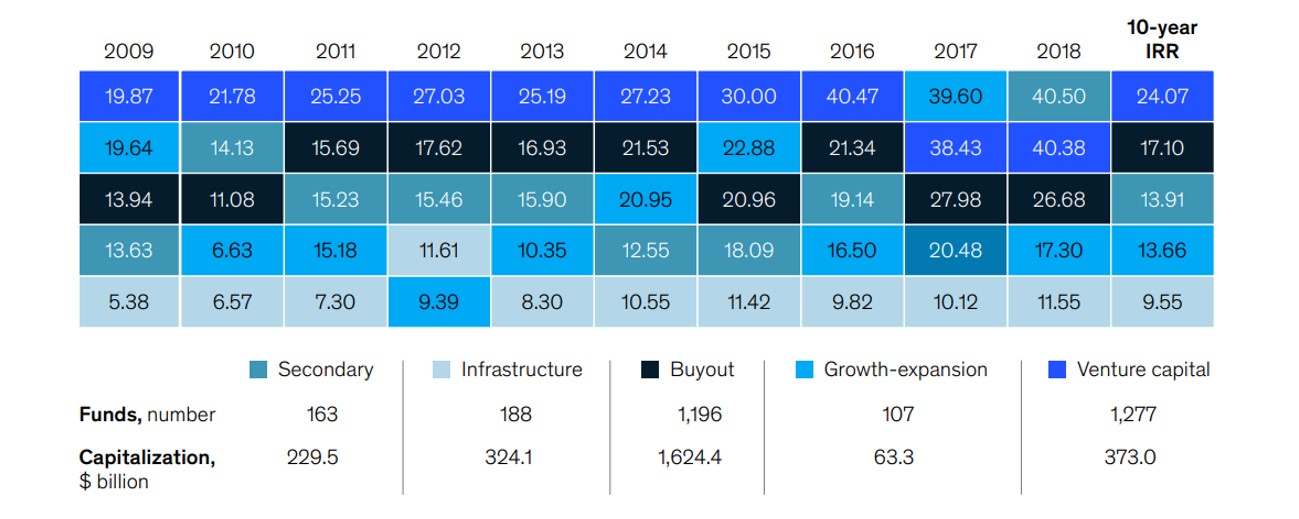

Below we showcase a chart from Burgiss that captures calendar year returns for various private market asset classes including buyout private equity funds.

Exhibit 5: Private Market Strategy Performance Comparison by Year of Fund Launch (Vintage)9

These higher returns can be explained by more direct financial alignment between investors and company management, the use of debt, long term investment hold periods and the skill of buyout managers.

Diversification

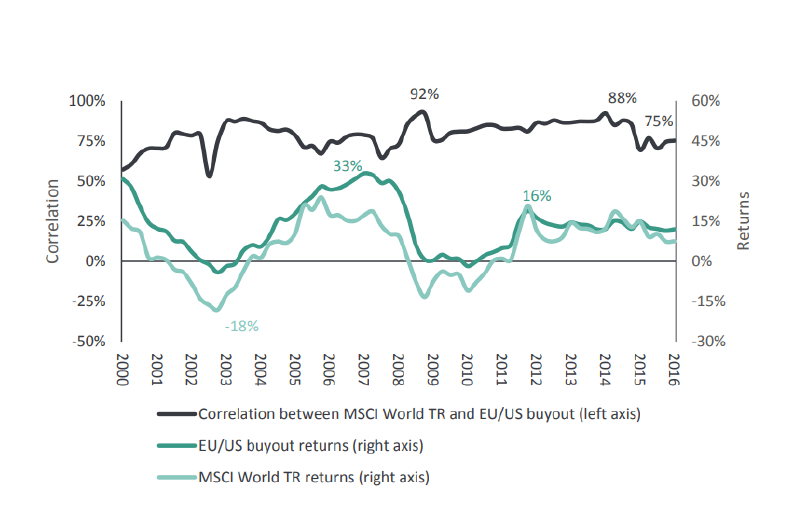

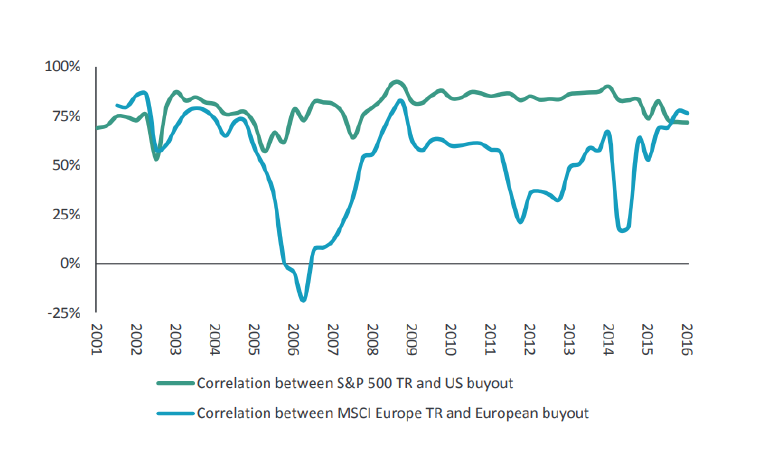

While private and public equity returns are correlated to an extent, private market inefficiency, direct asset ownership and full access to company information by buyout managers result in less correlation between buyout funds and public equities.

Sources of buyout fund diversification also stems from the types of company’s buyout investors invest in. Most buyout targets are stable, high cash generating businesses that may not be considered “sexy”. Comparing those types of companies with the ones that typically drive the performance of market cap weighted indices like the S&P 500 is a very different story.

Below we illustrate the degree to which private equity buyout investments move in similar patterns as public equities. In normal times, they move quite closely together, however, and very importantly, they can move in quite different patterns in times when public equities experience severe downward pressure.

Exhibit 6: Private Equity Buyout Correlations With Public Equities10

Volatility Reduction

Unlike public equities, buyout funds don’t have daily price discovery. Most buyout funds update pricing (mark) their underlying investments quarterly. This lack of daily pricing can reduce how much one’s portfolio moves up and down (volatility).

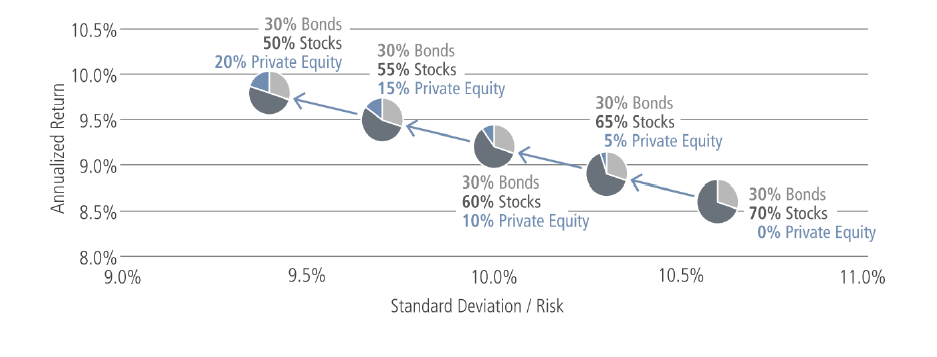

When private equity is combined with public equity and public fixed income exposure, it can result in improving portfolio return while also reducing portfolio risk (as measured by volatility and maximum drawdowns). Below we showcase this improvement in a risk and return chart.

Exhibit 7: Risk and Return of Stock/Bond/Private Equity Portfolios (Past 25 Years, Ending June 30, 2018)11

Risks and Considerations

Buyout Private Equity Funds have many upsides but they are not a silver bullet investment. The key risks of investing in buyout private equity include:

- Illiquidity Risk: Buyout Private Equity Funds typically lock-up investor capital for at least 5 years if not longer

- Interest Rate Risk: Buyout Funds take on significant leverage when they fund a transaction, which increases their sensitivity to interest rate shocks

- Economic Risk: Buyout Funds invest in various sectors of the economy and can be sensitivity to periods of economic stress that impact portfolio companies

- Fees: Buyout Funds charge higher fees than index funds and mutual funds – the average buyout fund charges 1-2% in management fees as well as a performance fee ranging between 10-20% if a certain return target is achieved

- Performance Disparity Risk: Selecting the right Buyout Funds to invest in can make a substantial difference in the investment return experience due to the significant disparity between top performing buyout funds and bottom performing funds

1Preqin as of December 2022.

2NASDAQ – “As Companies Stay Private Longer, Advisors Need Access to Private Markets,” August 2022.

3 Hamilton Lane – “Private Market Investing: Staying Private Longer Leads to Opportunity,” April 2022.

4 Hamilton Lane – “Private Market Investing: Staying Private Longer Leads to Opportunity,” April 2022.

5McKinsey & Company – “McKinsey Global Private Markets Review 2023,” as of March 21, 2023.

6McKinsey & Company – “McKinsey Global Private Markets Review 2022,” as of March 24, 2022.

7Corporate Finance Institute.

8Preqin – Global Private Equity and Global Public Equity returns as of March 2023.

9Preqin – Global Private Equity and Global Public Equity returns as of March 2023McKinsey & Company – “McKinsey Global Private Markets Review 2022” as of March 2022.

10Capital Dynamics, “Diversify your portfolio with private equity – Correlation between public and private equity.”

11Neuberger Berman – “Private Equity and Your Portfolio,” by Anthony D. Tutrone, Head of NB Alternatives, as of January 2019.