Everything is an Asset Class

Investing in Collectibles

Disclaimer: This article is only intended to provide you with general information. It is neither an offer to sell nor a solicitation of an offer to purchase any security and does not constitute, and should not be construed as, investment advice. Any statement about a particular investment or company is not an endorsement or recommendation to buy or sell any such security. The article is not intended to provide legal, accounting, financial or tax advice, and should not be relied upon in that regard. You are encouraged to seek independent advice. Every effort has been made to ensure that the article is accurate as of the date of first publication; however, we cannot guarantee that it is accurate, complete, or current at all times. The article may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

When I was in high school, I had a friend who bought a limited edition pair of Jordan 17’s (XVII). Instead of wearing them, he would sometimes bring them to school in a silver briefcase to show us. It reminded me of a scene out of a spy thriller where a man in a black suit had a briefcase full of state secrets handcuffed to his wrist. It was a strange sight to see a kid walking around with a silver briefcase containing a pair of sneakers instead of wearing them. Today, the idea of carefully storing a pair of limited edition sneakers would be encouraged in order to preserve their value. The resale market for limited edition sneakers has exploded, with some sneakers trading for thousands of dollars on resale platforms.

A recent study conducted by investment bank Cowen, estimates that the size of the North American sneaker and streetwear resale market is north of $2 billion, growing by 20%+ year over year with potential to reach $30 billion globally by 2030, a 15x increase.

Air Jordans are one example of the diverse, evolving universe of collectibles. Throughout history, enthusiasts have amassed collections of various kinds purely as an expression of their passion and interest. Over the last few decades, empowered by the internet, collectibles have begun attracting attention from individuals and entities who fall outside the world of enthusiasts. These new participants have entered the market for collectibles purely for financial gain, i.e. as speculators and/or investors. The growing size of the overall collectibles market, coupled with technological and financial innovation, has created a new era of collectibles ownership and investment; an era that features broader market participation (particularly from retail investors), more structured buying/selling and improving price transparency.

Sophisticated institutional and HNW investors have been relying on a variety of hedge fund strategies for many decades to generate uncorrelated returns, provide portfolio downside protection and solve for many other investment objectives.

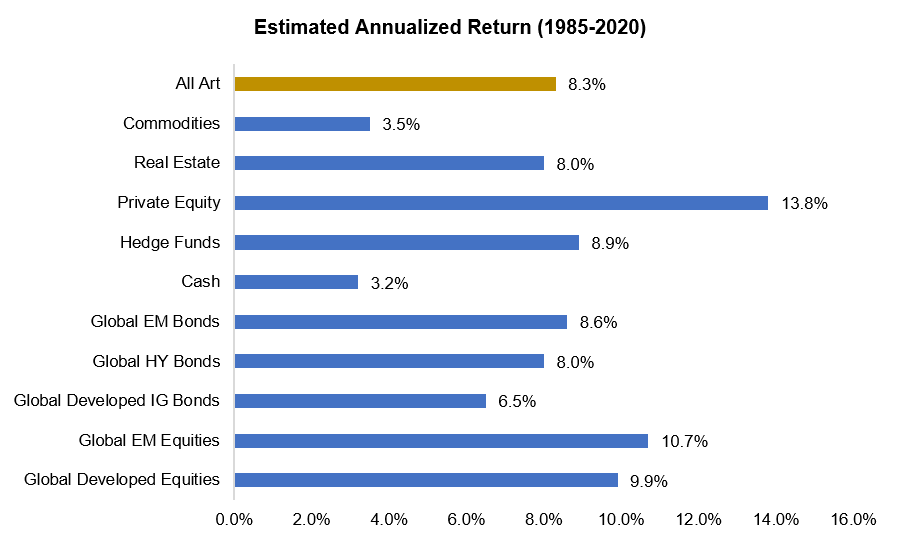

So now we know that collectibles are increasingly investable and clearly growing as an overall market. However, is there actual value in investing in collectibles? Or is this another space where the reality substantially defers from the hype? To figure this out, I’ve reviewed academic studies and industry reports to understand historical risk, return and correlation trends for a number of different segments of the collectibles market.

Investing in Collectibles – Separating Fact from Fiction

Before jumping into the findings, a few notes and definitions. Firstly, the summary analysis in this post focuses on parts of the collectibles market that are becoming increasingly investable for the average retail investor. This includes categories such as contemporary/fine art, fine wine, streetwear (rare sneakers, clothes), luxury goods, classic cars, and a collection of rare memorabilia (vintage comics, sports items, coins, stamps, etc.). All of these categories of collectibles are supported by dedicated investing platforms that are creating markets for specific or broad categories of collectibles. Secondly, historical returns for collectibles are represented by indexes that use a variety of methodologies to construct and monitor prices in each collectibles market. This brings us to our key definition:

Investable VS. Non-investable Indexes: An investable index is a combination of assets (usually listed securities) that can be accessed via one or more investment funds (or directly). Examples of investable indexes include the S&P 500 and the S&P/TSX Composite as both indexes can be invested in via a number of exchange traded funds (“ETFs”). Non-investable indexes use various methodologies to combine price data of assets in order to showcase a timeseries of “average” performance for a given asset class. However, as their name suggests, non-investable indexes cannot be invested in directly via an investment product as they are usually comprised of assets that are privately held, with price data that updates infrequently (due to less frequent buying/selling) and is not publicly accessible.

Historical performance information for collectibles is largely represented by non-investable indexes. This is an important distinction, as the performance of a given non-investable index may not necessarily represent the performance of any one collectible item. Therefore, it’s important to consider collectible index data with a grain of salt and not be swayed by attractive historical performance data. When investing in speculative assets like collectibles, it’s prudent to deeply evaluate the specific collectible, it’s investment merits, as well as costs and risks. You may be better off trying to access collectibles through an actively managed fund where the manager has deep expertise in investing in one or more collectibles category. Unfortunately, these kinds of funds are not broadly available to retail investors in Canada. Alternatively, some platforms will pre-vet the quality of collectibles they make available to investors, which de-risks the investment opportunity to some extent. Still, doing your own research is an absolute requirement when investing in collectibles. With that said, let’s review historical risk/return data for some of the largest categories of collectibles.

Investing in Collectibles – Contemporary Art

Historically, investing in contemporary/fine art was limited to the wealthiest segments of society. In 2017, the crown prince of Saudi Arabia paid $450 Million dollars, a record sale price, to acquire Leonardo Da Vinci’s Salvator Mundi via an auction held by Christie’s in New York. A mind boggling price tag and obviously severely out of reach for the average investor. However, in late 2017, fractional art investing platform, Masterworks, was launched, which opened up art as an asset class to accredited investors, allowing for substantially broader participation in a “walled garden” market. Through Masterworks, retail investors are able to acquire a fractional share of a contemporary/fine art work. Masterworks services include due diligence and evaluation of each piece of art, acquiring and storing the artwork, and securitizing the artwork into a fund (to allow for fractional ownership), and lastly, selling the art to realize a return.

Contemporary/fine art has a long history of buying/selling activity, which has been captured in several different well-known price indices. Below, we consider historical performance of art drawn from a few sources:

Citibank/Masterworks

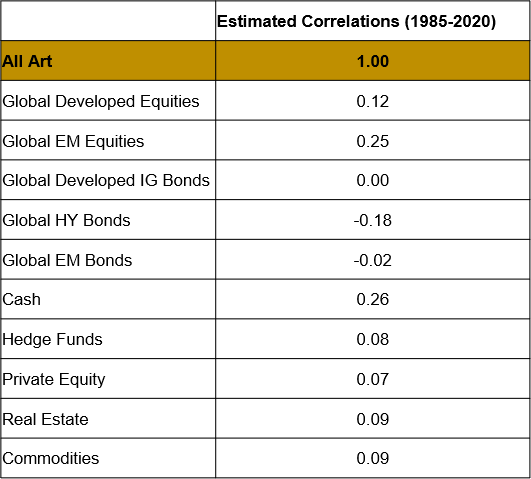

Sotheby’s Mei Moses Index

The graph below shows the Sotheby’s Mei Moses Index for the broader art market from 1950 to 2021. The index benchmarks at 1 in 1950 and shows the trajectory in demand for the overall market, a compound annual growth rate of 8.5%.

Artnet Index

A study produced by Deloitte in 2019 indicated that artnet’s index for the Top 100 Artists produced an 8% compounded annual growth rate (CAGR) between 2000-2018

In summary, it appears that art as a category has generated a long term return of ~8%, which seems to be consistent over different measurement periods. The correlation data cited within the Citibank/Masterworks research report suggests that art offers diversification benefits when paired with more traditional asset classes due to its low, and sometimes negative, correlations over time, with other asset classes. It does appear that investing in certain pieces of art may have investment merit over time, however, as I mentioned above, the average returns for the category may not reflect the realized returns for a given piece of art. This makes investing in art inherently risky and as such something to be pursued with caution.

Investing in Collectibles – Fine Wine

Earlier this month, the WSJ reported that a bottle of champagne was sold at auction for a whopping $2.5 million to two Italian brothers who had made their money investing in crypto and fashion. The bottle was a 2017 vintage magnum produced by Champagne Avenue Foch. The brothers who acquired the bottle have no intention on drinking the champagne, rather they intend to hold onto it as an investment. This is an increasingly common approach taken by investors and speculators within the market for fine wine and spirits.

According to research by Allied Market Research, the luxury wines and spirits market was valued at $970 billion in 2019, and is anticipated to reach $1.4 Trillion by 2027, a CAGR of 4.9%.

A trillion dollar market is nothing to sneeze at and suggests that this category of collectibles is a deep, mature market. Similar to art investing, fine wine and spirits investing has also been historically limited to high net-worth investors buying and selling privately via auction. However, new fintech businesses such as Cult Wines are opening up broader access to retail participants using innovate structuring and technology solutions.

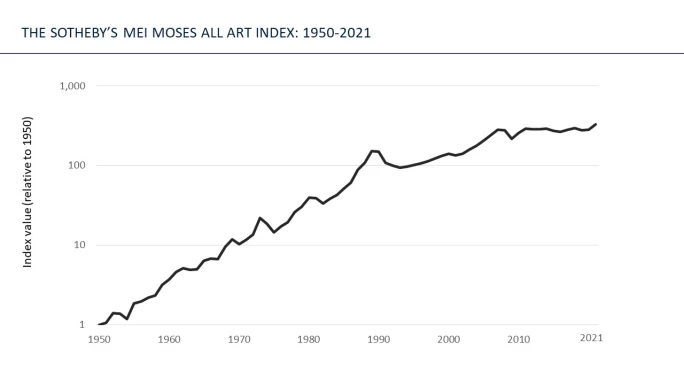

The price history for fine wine and spirits does not go as far back as contemporary/fine art, however, price data is being tracked by a dedicated exchange with data going back a few decades. Let’s review historical risk/returns:

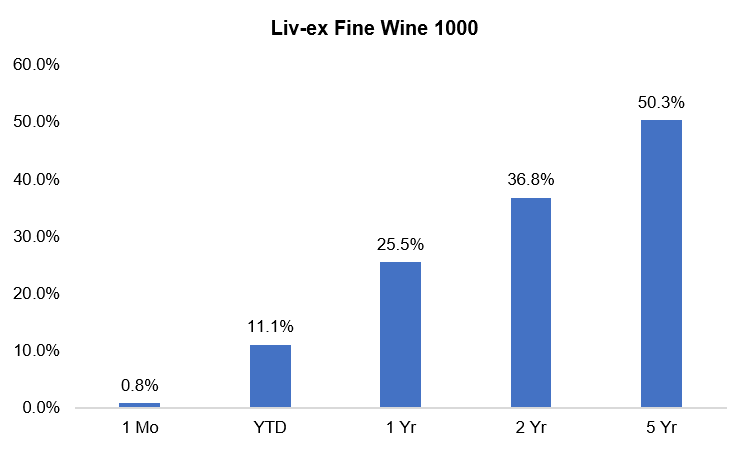

Liv-ex Indices

According to data from the London International Vintners Exchange or Liv-ex for short (captured in the chart below), fine wine has delivered 13.6% annualized returns over the past 15 years

In summary, fine wine investing seems to have yielded some impressive returns over the trailing few decades. The attractive short term performance, particularly in the current high inflation, low public market returns environment, seems to suggest that fine wines and spirits as a category may offer diversification benefits when held in conjunction with traditional asset classes. However, as is the case with art investing, fine wine and spirits investing suffers from the same variability in returns, when looking at a single vintage and comparing to average returns across many different vintages. Additionally, and as is the case with investing in any other collectibles, investing in wine, art, etc. all require the investor to be comfortable with long time horizons to realize returns (at least 5+ years).

Investing in Collectibles – Everything Else

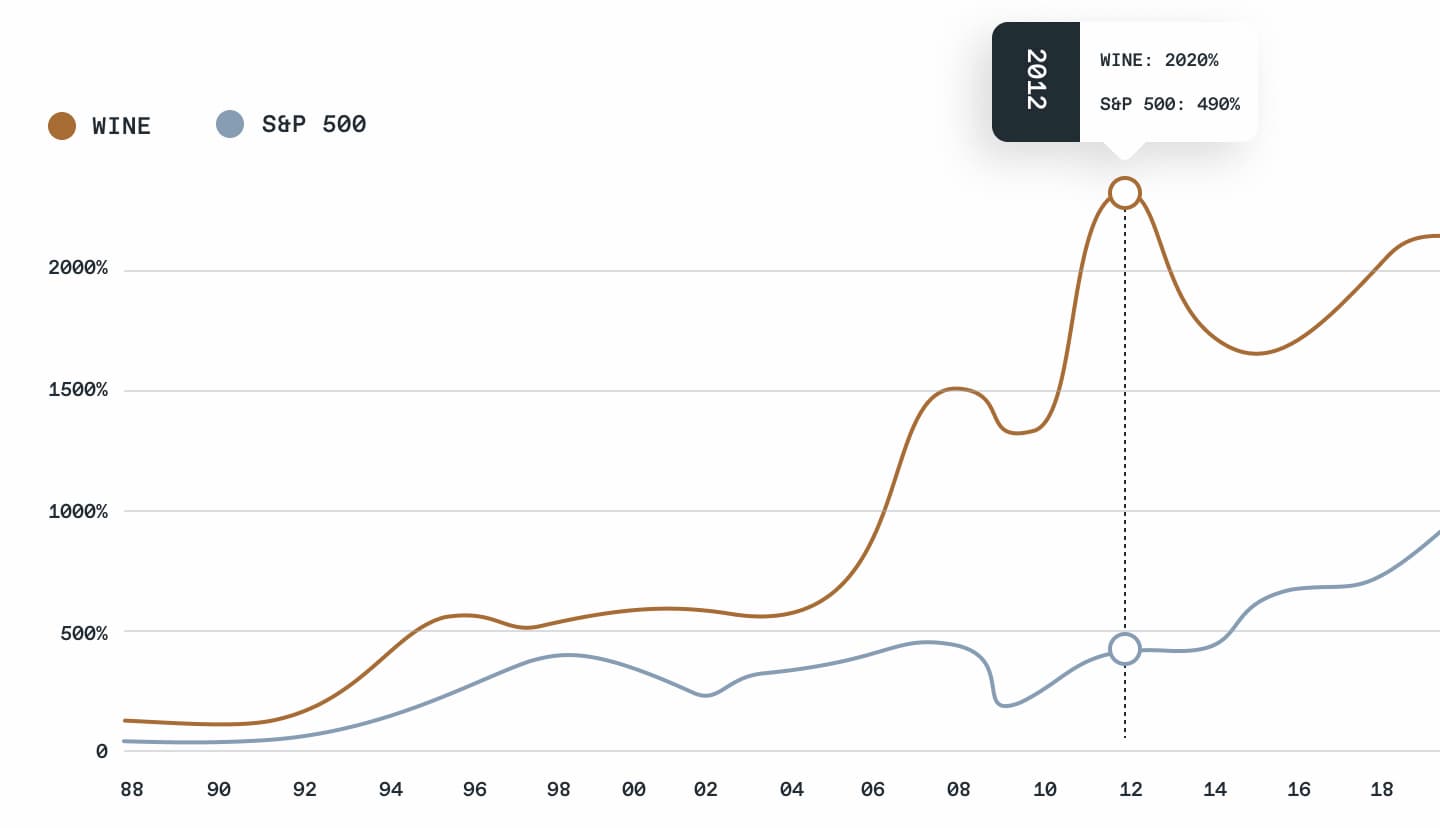

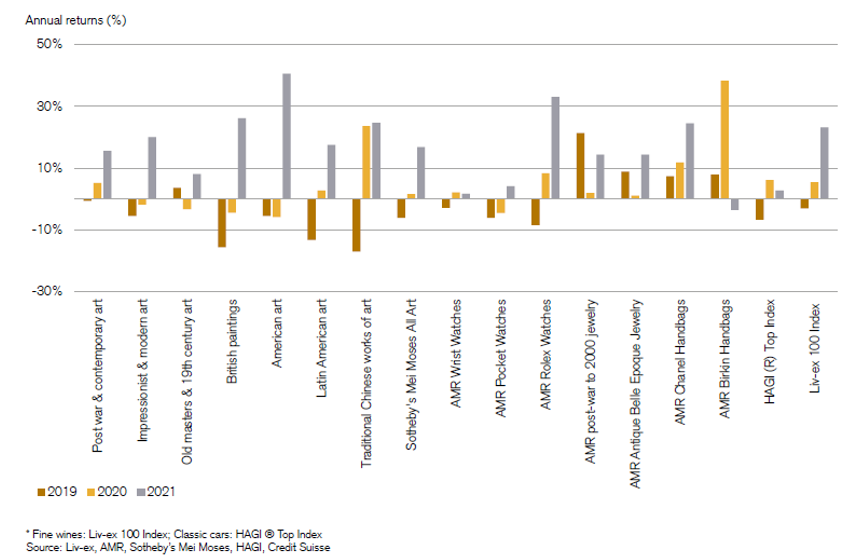

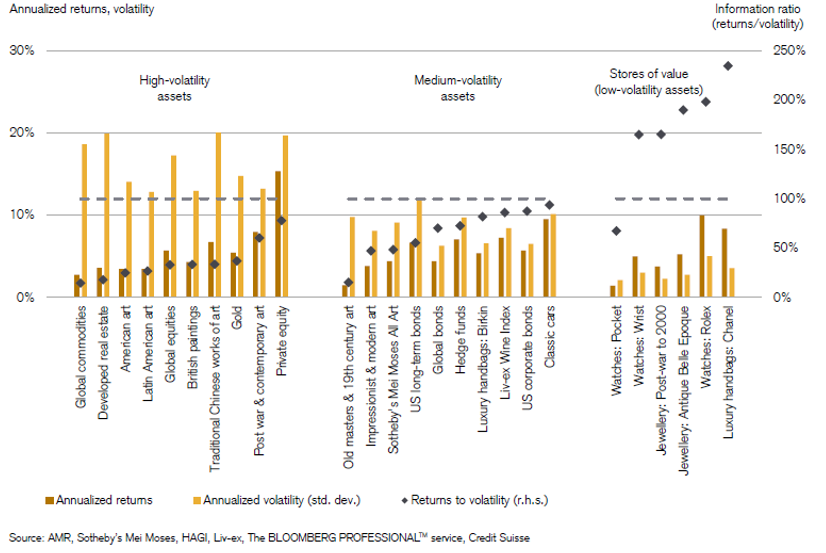

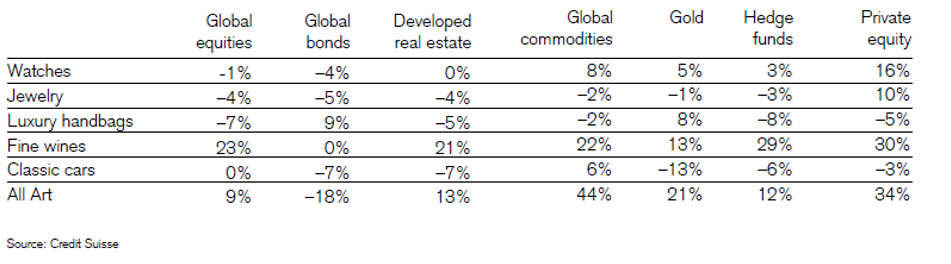

In order to keep this post to a sensible length, I’ve reproduced risk and return information sourced from a 2022 Credit Suisse & Deloitte report on collectibles that provides a comprehensive overview of performance metrics across a variety of collectible categories. If you’re interested in learning more, I strongly urge you to read the report as it’s one of the most comprehensive research reports on the collectibles space that I’ve come across. Let’s review the data:

The first chart showcases annualized returns for various categories of collectibles for the periods 2019-2021. While 2019 was a down year for most collectible categories, 2020-2021 saw a strong turnaround in a number of categories.

Looking at longer term returns, and organized by volatility, the chart below outlines performance of collectibles compared to how volatile their returns have been over time. Here you can see that watches, jewelry and luxury handbags have the lowest variability in returns over time whereas other types of collectibles can have price volatility that is in many cases as severe as stock market volatility.

With that said, price volatility is not the only measure of risk that matters. The table below outlines correlations of collectibles when compared to traditional and other alternative asset classes. It would appear that investment returns for collectibles are generally uncorrelated to traditional and other alternative investments, which may suggest collectibles can provide positive diversification benefits when held alongside other, more traditional investments.

All said, and in my personal opinion, the jury is still out on collectibles as investable asset classes for the average retail investor. Most categories of collectibles are still beyond the reach of retail investors due to costs and complexity. However, technological innovation and the ongoing financialization of all kinds of assets make it a very real possibility that collectibles may one day have a place in investment portfolios. The recent explosion of interest in Non-Fungible Tokens (NFTs) is one example of how technology is reshaping the world of collectibles, creating new communities of interested market participants in art as well as all types of other physical and digital collectibles.

So if you’re wondering why it’s so difficult to buy the latest pair of Air Jordan’s, the newest limited edition watch you’ve been eying, a high-end handbag or even a limited edition LEGO set, mystery solved! You’re competing with buyers who are in it for reasons other than fashion and passion.