Understanding Private Real Estate

Understanding Private Real Estate

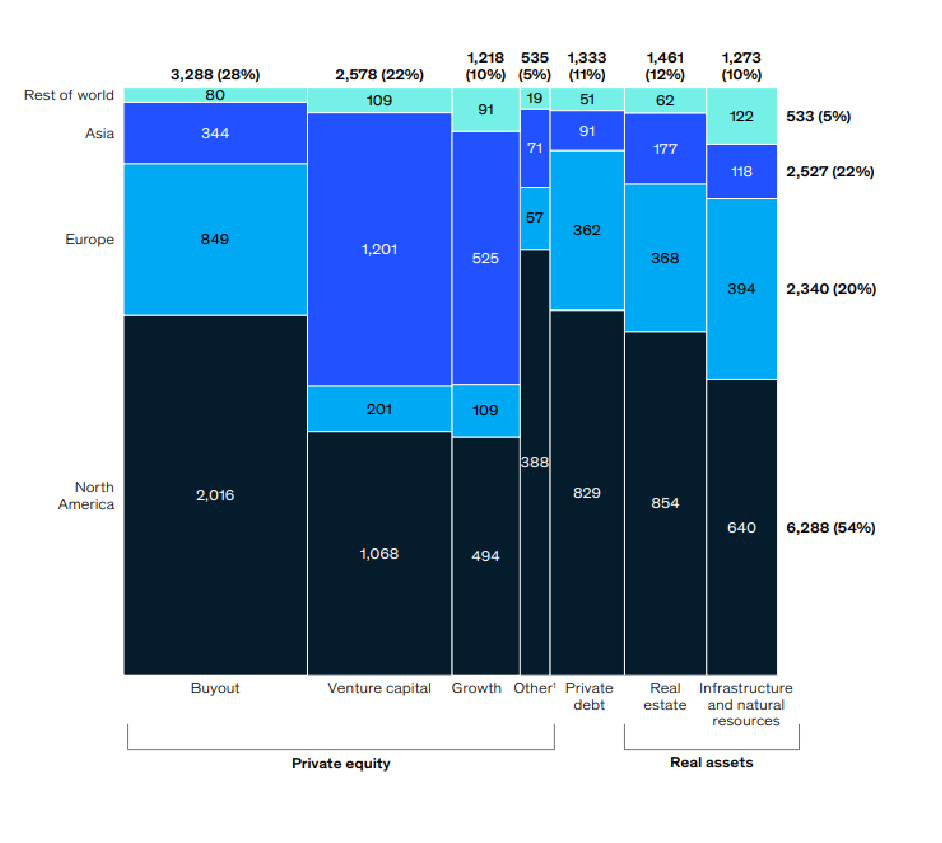

Private Real Estate is amongst the oldest alternative investment asset class and has a long wealth creation track record. It is also the largest segment of the Real Assets category within private alternative investments.

Private Real Estate makes up an estimated 12% of all private alternative assets under management (AUM), totaling $1.5 Trillion USD, globally. Over the last 10 years, Private Real Estate AUM has grown at a ~10% CAGR and continues to be a core asset allocation for a variety of institutional and retail/private investors.

Exhibit 1: Private Real Estate Assets Under Management1

Unlike public real estate investments like the shares of publicly listed real estate investment trusts (“REITs”), private real estate is broader and consists of a greater variety of investment strategies.

What’s So Great About Private Real Estate?

Private real estate is real estate that actually behaves like real estate. What does this mean? It simply means that unlike share ownership in publicly listed REITs, that tend to fluctuate with the overall market, private real estate behaves in the way you would expect real estate to behave i.e., stable prices and yields over time.

As public equities, listed REIT prices can move daily against the REIT’s underlying property value (Net Asset Value or NAV). Private real estate typically has lower correlations to public markets and has asset valuations that are derived from property fundamentals and not directly impacted by public market volatility or sentiment.

Additionally, private real estate offers more ways to access the asset class.

Public REITs focus on specific property types like offices, retail stores, medical complexes, industrial buildings, or apartment buildings but do not always have a focus on specific kinds of development or investment strategies.

With private real estate, most funds focus on property types and specific investment/ development strategies that can offer investors distinct risk and return profiles. This gives investors more choice to be able to make a more targeted allocation in line with their expected risk profile and investment objectives.

Below, we illustrate some of the differences between Public and Private Real Estate when it comes to yields (capitalization rates), valuations and sensitivity to interest rates and the overall market.

Exhibit 2: Drivers of Real Estate Performance 2

| Type | Public | Private |

|---|---|---|

| Capitalization Rates | Yield can vary significantly from the underlying assets | Yield closely reflects rate of the underlying assets |

| Valuations | Large variations from NAV due to public market volatility and investor sentiment | NAV more closely reflect the actual value of underlying holdings |

| Type | Public | Private |

|---|---|---|

| Interest Rates | Highly sensitive to changes in interest rates and fixed income market trends | Historically less sensitivity to changes in interest rates and fixed income market trends than public markets |

| Public Market Sensitivity | Valuations driven by supply and demand and capital flows in public equity markets | Low sensitivity to public equity markets |

What are the Different Types of Private Real Estate Investments?

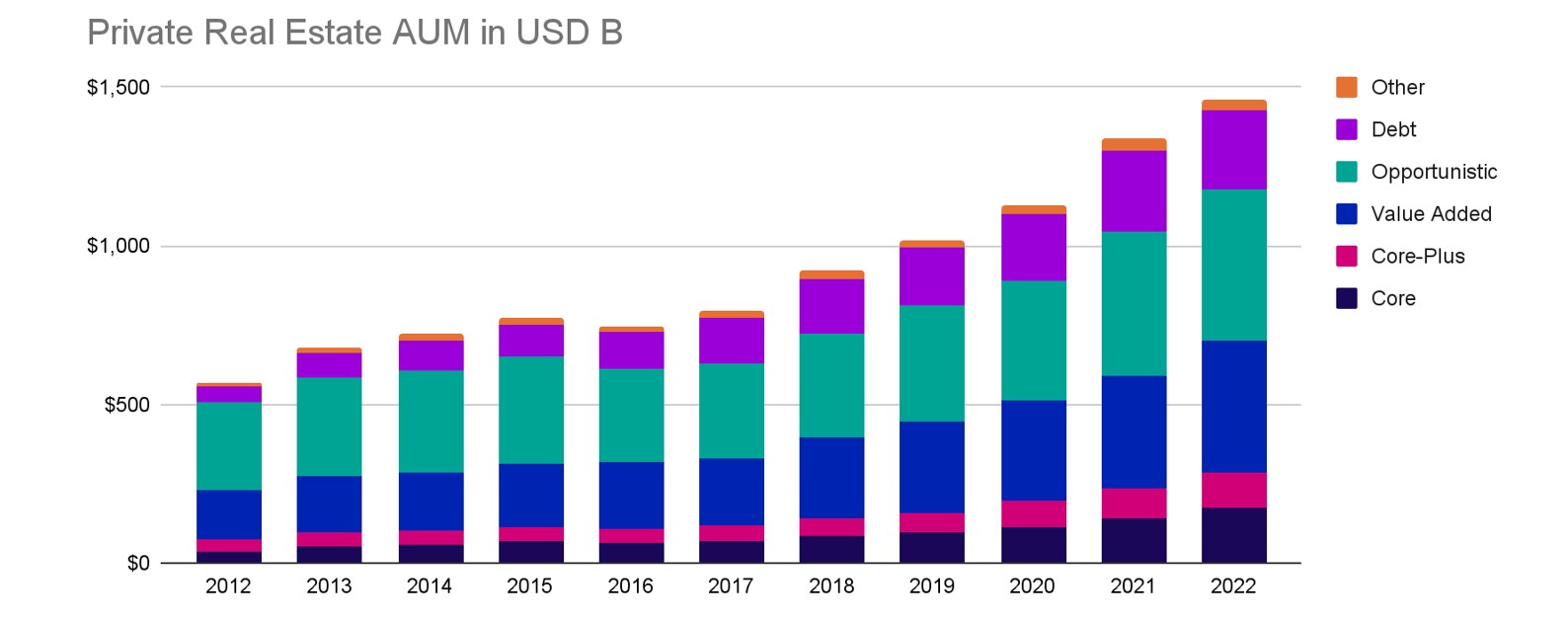

Private real estate investments are typically classified by the quality of the target property type. Below, we capture the primary types of investment strategies employed by private real estate funds.

| Type | What it is | Risk Level | Return Potential |

|---|---|---|---|

| Core | Investor purchases high quality, turnkey, cash flow generating assets like fully leased apartment, retail, or industrial buildings. | Low | Low |

| Core-Plus | Mix of core and value-added properties. | Medium | Medium |

| Value Add | Investor purchases existing properties, fixes them up and redevelops them. | Medium- High | Medium- High |

| Opportunistic | Investor purchases undeveloped land and develops it or turns around underperforming properties. | High | High |

How To Invest in Private Real Estate

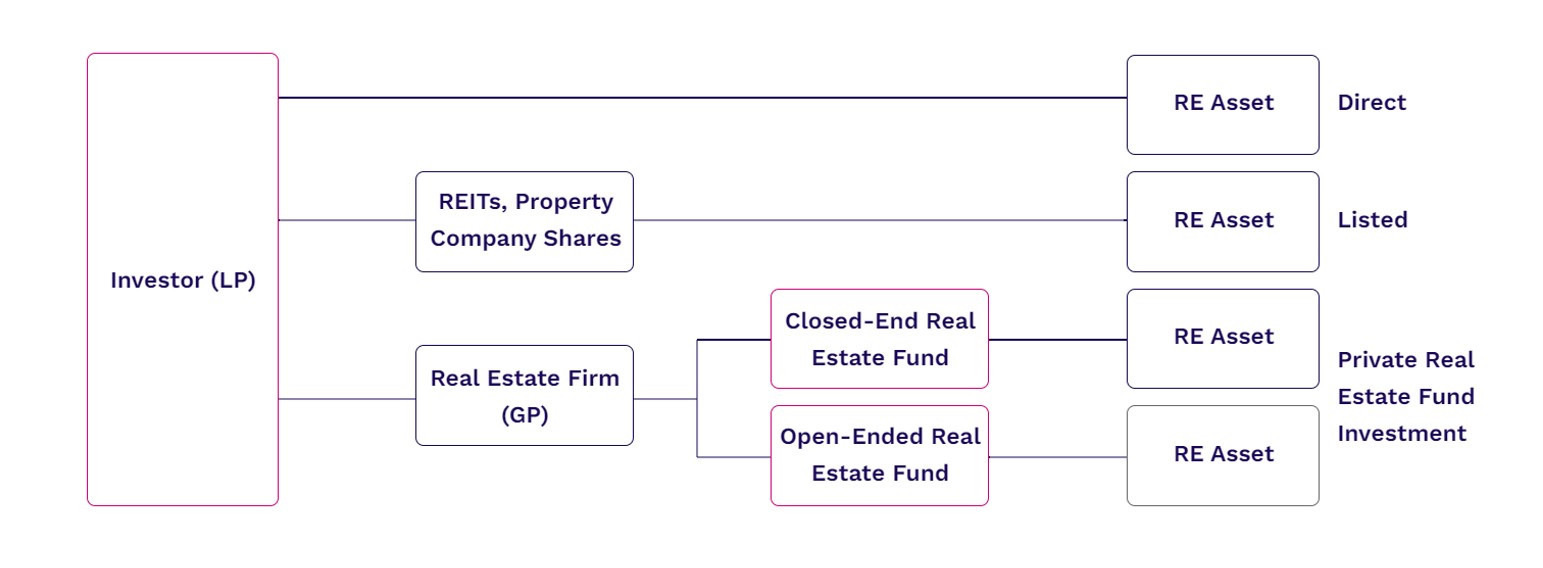

Investing in private real estate can be done in several ways:

- Direct equity ownership of individual properties

- Indirect equity ownership through pooled investment funds or non-traded REITs

- Direct ownership of real estate debt (Private Mortgages, Commercial Mortgages, Construction loans, etc)

- In-direct ownership of real estate debt through pooled investment funds

- Online real estate equity crowdfunding platforms

Most sophisticated investors like pensions, sovereign wealth funds and Ultra-High-Net-Worth families, invest in private real estate through a combination of direct real estate ownership and closed or open-ended pooled investments funds. Closed-end funds have historically been the most popular structure for institutional investors.

Below we illustrate some of the ways an investor can obtain exposure to private real estate.

Exhibit 3: Simplified Real Estate Investment Breakdown3

In a closed-end fund, investor capital is locked up for a specific period and cannot be accessed until the end of the fund’s life.

Closed- end restrictions have led to an explosion of interest in open- end funds which provide investors with liquidity within a certain period. While open-end funds aim to provide investors with liquidity, it is possible for a manager to limit redemptions if a lot of investors want their money back at the same time. This process is called ‘gating redemptions’ and is applied to ensure redemptions are conducted in an orderly manner and fund assets are not liquidated under duress.

As real estate is a popular and well understood asset class, real estate equity crowdfunding has soared in the last five years and is one of the easiest, mainstream ways for individual investors to invest in private real estate.

Exhibit 4: Private Real Estate Strategy AUM Breakdown Overtime4

Other = Distressed and Co – Investments

How Will Private Real Estate Help My Portfolio?

Diversification and Volatility Reduction

Real estate in general can help diversify a portfolio but private real estate can create greater diversification benefits as it is not publicly listed. Longer-term investment horizons and non-daily price discovery insulates private real estate from public market volatility and sentiment.

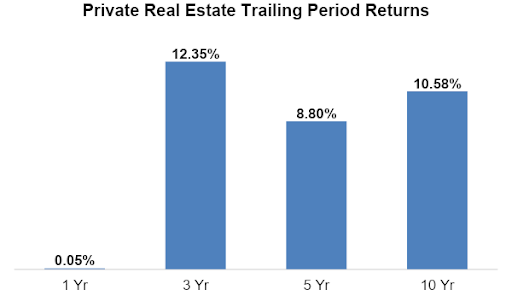

Income and Capital Growth

Real estate has proven itself as one of the best asset classes for both capital growth and cash flow production. Income producing properties can generate attractive yields relative to other income-oriented asset classes and, as a property’s cash flow grows, so does the value of the real estate. Below, we highlight the trailing period annualized returns for private real estate

Exhibit 5: Private Real Estate Strategy AUM Breakdown Overtime5

Inflation Hedge

Inflation is one of the biggest threats to an investor but real estate can act as a unique hedge. The ability to raise rents and track against replacement rate costs due to commodity prices creates built-in inflation protections.

Risks and Considerations

Private real estate is one of the most susceptible alternative investments to macro factors like: the general health of the economy, interest rates, demographic trends, migration, lack of liquidity, environmental factors, and the use of leverage.

It is also subject to property or location specific risks like local economies, zoning and bylaws changes, lease structures and property replacement costs.

This multiplicity of risks makes it incredibly important for private real estate investors to possess a strong understanding of what drives specific types of real estate but also, local property market dynamics.

Lastly, like other private investments, private real estate investment funds often carry two layers of fees including a management fee (ranging between 1%-2%) and a performance fee (ranging between 10%-20%) that kicks in if the fund achieves a certain predetermined return (known as a hurdle rate).

1 McKinsey & Company, “McKinsey Global Private Markets Review 2023,” as of March 2023.

2Benefit Street Partners, “Why Private Real Estate? A Closer Look Inside an Asset Class that Offers a Range of Potential Benefits for Investors” as of March 2021.

3 Preqin.

4 Preqin.

5Preqin, as of March 2023. Private real estate is represented by Preqin’s Quarterly Private Real Estate Index represented net annualized returns for the trailing periods displayed (ranging between 10%-20%) that kicks in if the fund achieves a certain predetermined return (known as a hurdle rate).