Understanding Private Infrastructure

Understanding Private Infrastructure

Private Infrastructure investment strategies typically involve investing in physical and digital infrastructure assets such as toll roads, airports, power plants, water treatment facilities, and server farms.

Private infrastructure, as an asset class, has long been the domain of the largest and most sophisticated investors on the planet as investing in infrastructure assets is complex, requires large amounts of capital, long investment hold periods, specialized knowledge, and often, relationships and collaboration with domestic and international government agencies.

Today, private infrastructure investment opportunities are being considered by a variety of investors who are looking for diversified sources of returns that provide inflation protection, yield, and the potential for capital appreciation. As many nations around the world grapple with upgrading aging infrastructure as well as the implications of transitioning to sustainable sources of energy, infrastructure investing continues to be an attractive asset class for investors.

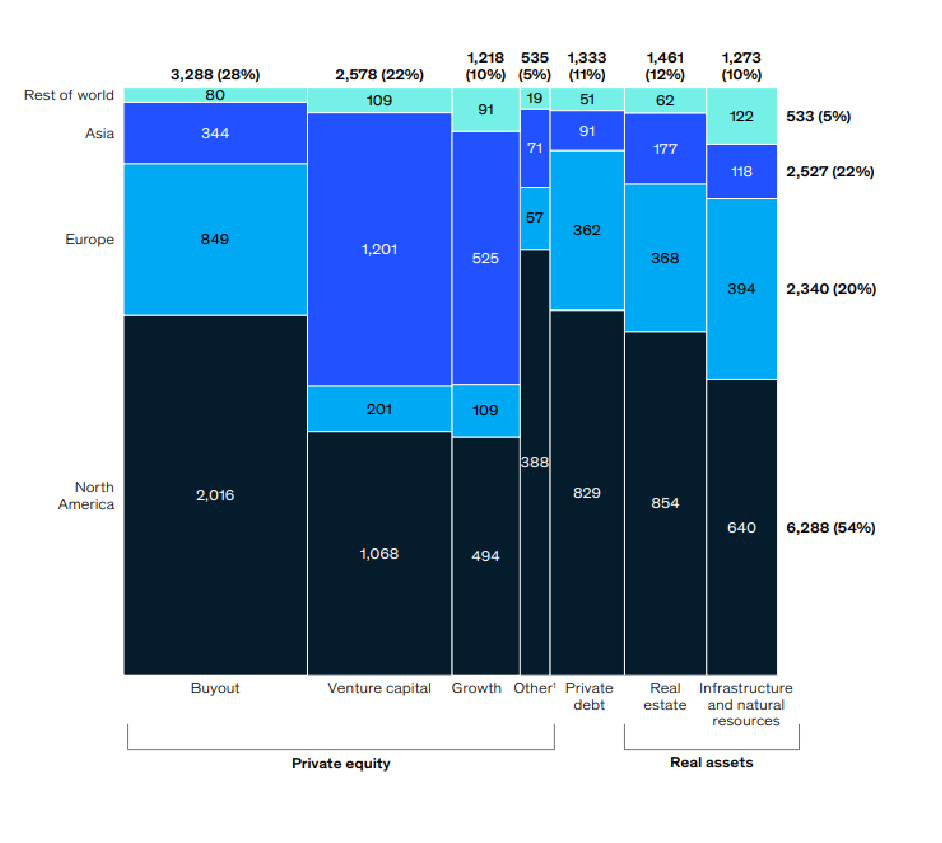

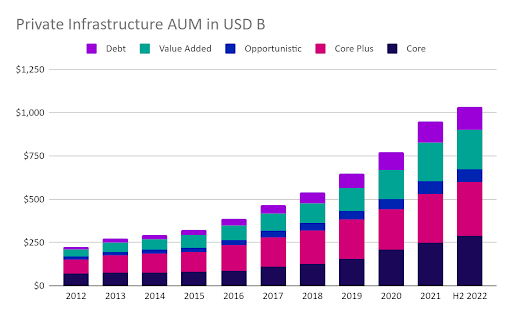

As of H2 2022, infrastructure made up 9% of all private alternative assets under management(AUM), totaling $1.03 Trillion USD globally. Over the last 10 years, private Infrastructure AUM has grown by a ~18% CAGR.

Exhibit 1: Private Infrastructure Assets Under Management1

Exhibit 2: Private Infrastructure AUM Growth2

What’s So Great About Private Infrastructure?

Private infrastructure offers many benefits like stable cash flows, capital appreciation, inflation protection, and low correlations with other asset classes. Since infrastructure assets are often essential services with long-term contracts, built in inflation adjustments and regulated pricing, they can be attractive options for long term investors. Infrastructure benefits from high barriers to entry, long operating lives and being inherently defensive.

Like real estate, infrastructure can be accessed through private or public means. There are many publicly traded companies who build or manage infrastructure assets and ETFs or mutual funds that invest in baskets of infrastructure stocks.

The public equity qualities of listed infrastructure securities, however, are a key drawback that can make them less attractive when compared to private infrastructure investment funds.

Additionally, private infrastructure can offer more ways to access the asset class when compared to listed infrastructure investment strategies.

Public infrastructure stocks often focus on specific asset types, but do not always have a focus on specific stages of development or provide exposure to investment strategies with distinct risk and return characteristics.

With private infrastructure, most funds focus on asset type and specific investment/ development stages that can provide meaningfully distinct risk and return characteristics. This empowers investors to make more strategic and targeted allocations to the asset class. Below we highlight some of the differences between investing in public versus private infrastructure funds.

Exhibit 3: Key Differences Between Typical Public and Private Infrastructure Funds

| Private | Public | |

| Liquidity | Lower | Higher |

| Volatility | Lower | Higher |

| Control | Higher | Lower |

| Portfolio | More Concentrated | More Diversified |

| Performance | High | Lower |

| Access | More Limited | Less Limited |

What are the Different Types of Private Infrastructure Investments?

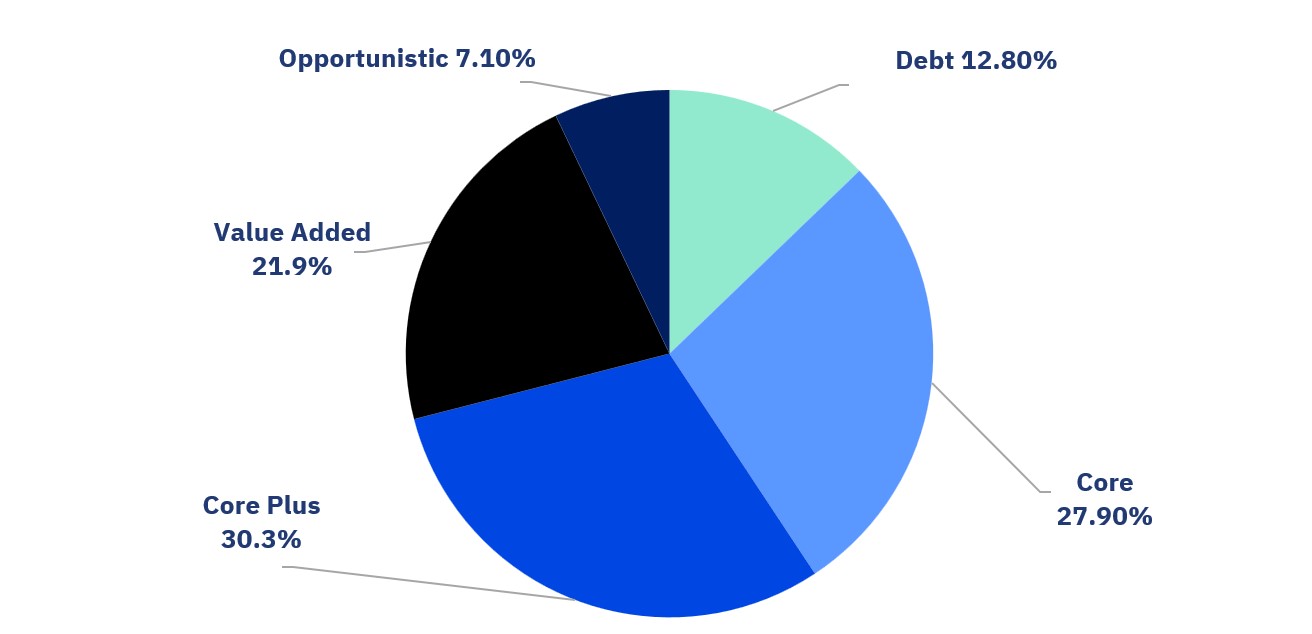

Like real estate, private infrastructure strategies are segmented based on risk and return profile and asset type (quality of the asset).

| Type | What it is | Risk Level | Return Potential | Returns Source |

| Core | Low-risk investments with low leverage that generate predictable and stable returns over a long period of time. | Low | Low | Cashflow |

| Typically involves essential assets like toll roads, airports, and water treatment facilities that provide basic services to the public. | ||||

| Core Plus | Similar asset type as core but may require some enhancement, upgrade, or repositioning. May include the addition of new facilities, expansion or renovation of existing facilities, or the introduction of new technologies. | Medium | Medium | Cashflow and Capital Growth |

| Value Add | Projects that involve more hands-on work to enhance the asset value and higher amounts of leverage. May include repositioning the asset or redeveloping the asset. | Medium- High | Medium- High | Capital Grow and Some Cash Flow |

| Opportunistic | Typically involves either underdeveloped assets or assets that require significant redevelopment. May also involve assets in emerging markets or those with a higher degree of leverage. | High | High | Capital Growth |

Exhibit 4: Private Infrastructure AUM By Strategy (H2 2022)3

How To Invest In Private Infrastructure

Investing in infrastructure can be done in several ways however large capital commitments tend to be needed given the size of infrastructure projects. For those with the capital to commit, they can get access to this asset class through:

- Direct equity ownership of individual infrastructure assets

- Indirect equity ownership through pooled investment funds

- Direct ownership of infrastructure debt

- Indirect ownership of infrastructure debt through pooled investment funds

Most institutional investors like pensions and sovereign wealth funds, invest in private infrastructure through closed or open-ended pooled investments funds that typically carry long lockups (at least 3+ years). Closed-end funds have historically been the most popular. Many managers, however, have started offering open ended infrastructure investment funds for those investors who value liquidity.

Since institutions who invest in infrastructure through a specialized fund manager may also make direct investments themselves, many fund managers offer co-investment opportunities that allow a fund’s investors to both invest in a manager’s fund while also participating in direct ownership of individual assets held by the fund.

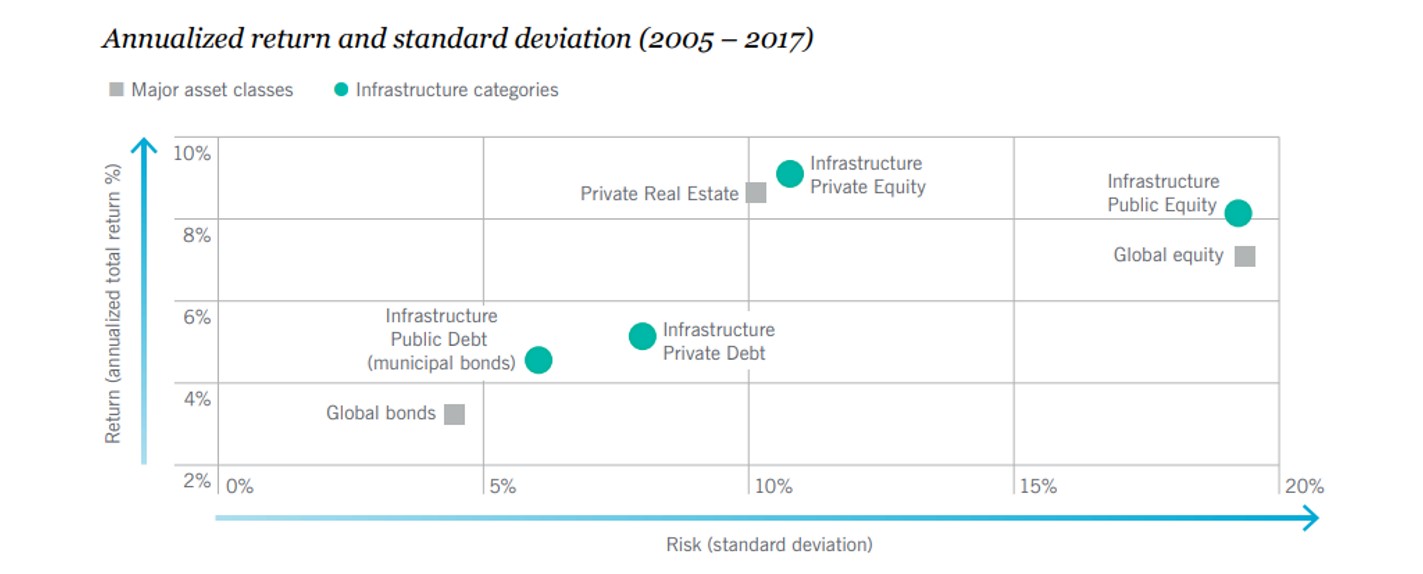

Exhibit 5: Infrastructure Risk/ Return vs major asset classes4

How Will Private Infrastructure Help My Portfolio?

Inflation Hedge

Infrastructure assets have a built-in way to keep up with inflation, either through contracted revenue rates or regulations that allow for price increases. This means infrastructure investments can be directly indexed to inflation. While these contracted price increases vary across asset types, infrastructure has a unique ability to deliver returns that keep pace with the rising cost of living.

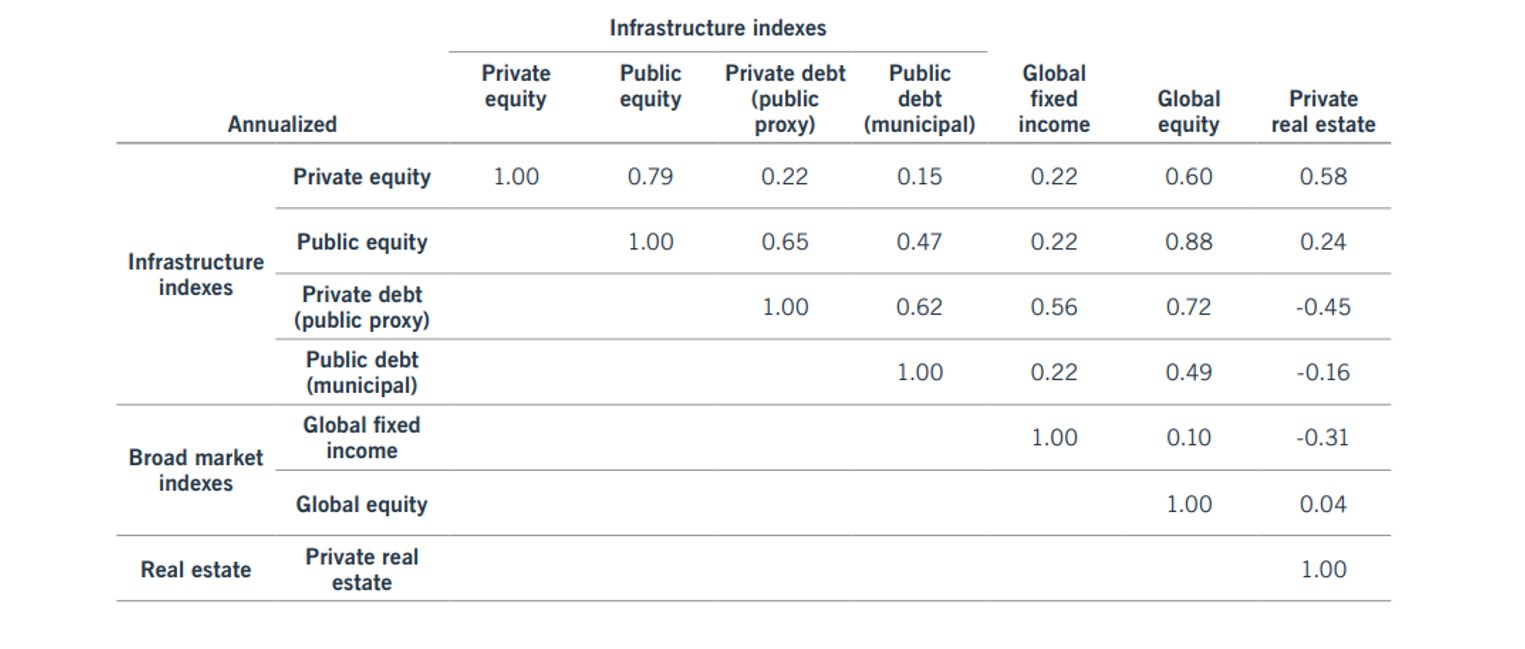

Diversification

Every infrastructure project is different and has unique project specific qualities. Therefore, infrastructure assets have very little correlation to public markets. Additionally, infrastructure’s income orientation and predictable long-term cash flows tend to reduce sensitivity to public market volatility.

Exhibit 6: Private Infrastructure Correlations5

Income and Capital Growth

Access to stable and sustainable cash flows is one of the key reasons to invest in infrastructure. Given these assets tend to come with a regulated and contracted revenue model, they have clear and predictable revenue that can be distributed out to investors. Additionally, depending on the type of assets one is invested in, there is the opportunity for significant capital appreciation for more risky or undeveloped projects.

Exhibit 7: Private Infrastructure Trailing Period Returns6

Risks and Considerations

Private Infrastructure is a compelling asset class to explore but it is complex and comes with several unique risks.

Infrastructure assets are subject to a significant amount of regulatory risk that could affect revenue and development costs. This is especially true if assets are in different parts of the world which they often are. Governments tend to prefer managers with a long track record, good reputation, and true focus on the communities they operate in. There are also legal restrictions across geographies which dictate how much ownership a foreign body can have of another country’s assets, so managers need to be highly skilled in navigating these complexities.

Infrastructure assets may also be impacted by major changes in technology. For example, if new technology is developed to deliver or produce energy in different ways, existing energy assets may be put at risk.

Like other types of alternatives, infrastructure is illiquid, and requires an especially long-time horizon to invest.

Lastly, and as is the case with most private market investments, private infrastructure funds typically carry two layers of fees including the management fee (ranging from 1%-2%) and a performance fee (ranging from 10%-20%), which is typically applied if a pre-determined return is achieved by the fund (hurdle rate).

1McKinsey & Company, “McKinsey Global Private Markets Review 2023,” as of March 2023.

2Preqin.

3Preqin.

4Nuveen, “Infrastructure: Opportunity for yield and diversification”, 2018.

5Nuveen, “Infrastructure: Opportunity for yield and diversification”, 2018.

6Preqin as at 03/2023. Private Infrastructure returns reflect Preqin Quarterly Private Infrastructure Index data, net of fees.