Understanding Venture Capital

Understanding Venture Capital

Venture capital (“VC”) is a subset of Private Equity that focuses on primarily equity investments in early or growth stage private companies. Many the world’s preeminent technology companies were at one time venture-backed startups looking to change the world with innovative technology-based solutions.

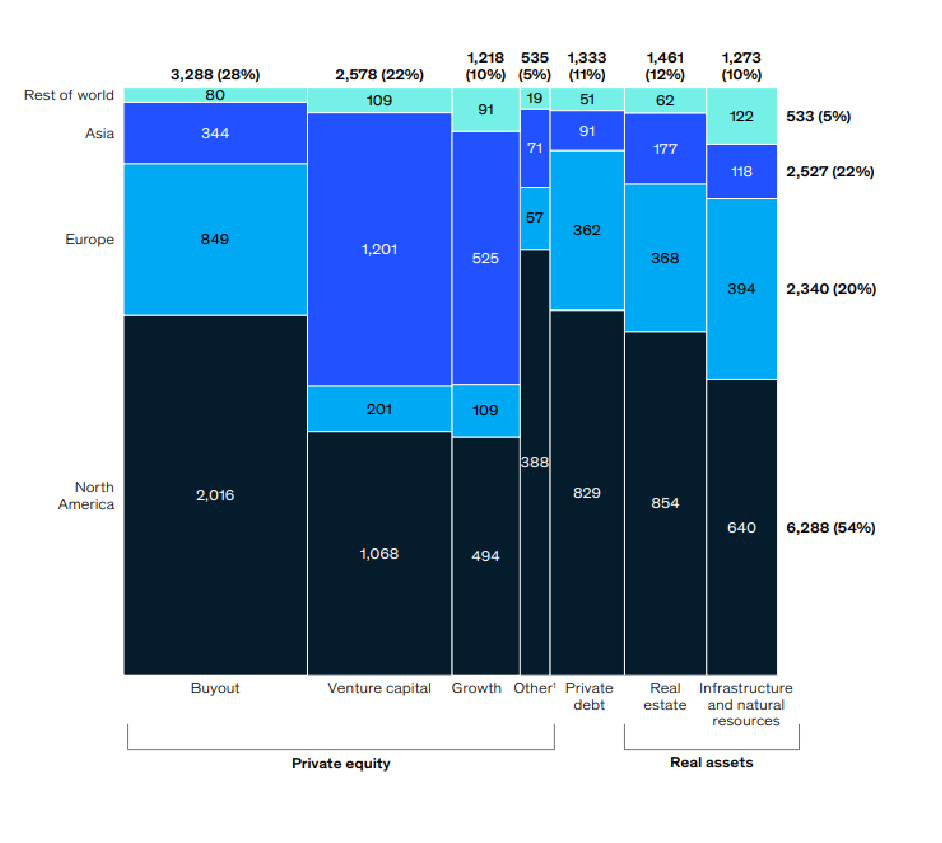

As of H2 2022, VC made up 22% of all private alternative assets under management (AUM), totaling $2.6 Trillion USD globally.

Over the last 10 years, Venture Capital AUM has grown at a 24% CAGR and continues to grow in popularity amongst all types of investors.

Exhibit 1: Venture Capital Assets Under Management1

Exhibit 2: Venture Capital AUM Growth2

What’s So Great About Venture Capital?

The most attractive thing about VC is its ability to provide access to the newest and most exciting companies before they become mature, public companies. As an unwritten rule, venture capital investments are almost exclusively focused on companies that substantially leverage cutting edge technology as a core part of their business.

When making investments, VC investors typically take ownership stakes in early-stage private companies that they believe may see a substantial increase in valuation in the coming years. Given the risk inherent in venture investing, VCs look for outsized returns from their investments that far exceed the return targets attached to investing in more mature companies.

Below we outline the different types of venture capital investments by the company stage they typically.

What are the Types of VC Investments?

There are several types of VC investments that take place across the lifecycle of a company.

| Type | Description | VC or PE? |

| Seed | Earliest stage of VC, where investors provide capital to entrepreneurs or startups to develop their initial ideas and build their products or services. | VC |

| Series A – E (Pre IPO or Growth Capital) | Later rounds of funding that come after seed rounds. Series A is provided to companies that have developed a viable product or service and have demonstrated some traction in the market.Series B – C is provided to companies that are looking to expand their operations.Series D-E is reserved for companies that are close to going public or being acquired. This type of funding is also sometimes referred to as growth capital. |

VC or PE |

How To Invest in Venture Capital

Investing in VC, particularly high-quality VC, is challenging. VC funds restrict who can invest in their funds and, in certain cases, only allow investment opportunities by invitation. This exclusivity ensures that VCs attract the right long-term investors that share similar values. Getting invited to invest with a world class VC firm can be like getting an invitation to buy a rare, limited run Ferrari. VCs also limit the size of their funds because the bigger a fund is, the more difficult it is to hit their returns thresholds.

Investing in traditional VC is primarily done through closed-end funds that lock investor money for 10 years. The reason for these long lock ups is that businesses take a long time to get off the ground and when a VC makes an investment, they need to budget additional capital in the fund for participation in follow-on funding rounds. This is particularly important for seed, and series A-C investments.

If one does not have direct access to a VC fund, it is possible to invest in VC through a fund of funds. This is a fund that invests in other VC funds.

As VC has gotten more popular, new flavors of it have popped up. Equity crowdfunding and secondary private share marketplaces have been two of the most popular. Private Wealth Managers, Investment Advisors and some Robo Advisors have also started offering individual investors access to VC investments through their exclusive relationships.

How Will Venture Capital Help My Portfolio?

Venture capital can contribute to one’s portfolio in many ways including:

High Potential Returns

Since VC investments are made in earlier stages of a company’s life, they carry significant upside. Over the last 5 years, VC funds have returned a median three year rolling annualized return of 20%. There are many stories of billion-dollar VC exits on investments of hundreds of thousands, so a few good VC investments can drive a large percentage of your portfolio’s performance over time.3

Risks and Considerations

Despite being one of the highest profile and highest return potential types of alternative investments, VC is one of the riskiest segments of alternatives.

Early stage businesses have over a 80% failure rate after one year, so most VC investments lose money. To hit their returns thresholds, VCs shoot for 2-3 big winners in each of their funds to make up for losses from bad investments. Finding and making the right investments is a competitive business so sourcing these big winners comes down to skill, reputation, and the ability to convince founders to take their money. It is not uncommon for VCs to fight over who they invest in which over time can inflate VC deal valuations.

Additionally, like other types of alternatives, VC is illiquid, meaning that investors may not be able to access their capital for several years. Unlike alternatives like private equity, private debt, and private real estate, it’s less common for VC funds to offer liquidity.

Lastly, VC funds can carry some of the most expensive and confusing fee structures in alternatives. VC funds established between 1983 and 2023, charged a median management fee of 2%, carried interest of 20% and had a preferred return hurdle rate of 8%. This means that in addition to the 2.0% management fee, the fund manager is entitled to 20% of funds’ returns that exceed an 8% threshold.4

1McKinsey & Company, “McKinsey Global Private Markets Review 2023,” as of March 2023.

2Preqin

3 Preqin

4 Preqin