Private Equity goes Pro

Investing in Professional Sports

Disclaimer: This article is only intended to provide you with general information. It is neither an offer to sell nor a solicitation of an offer to purchase any security and does not constitute, and should not be construed as, investment advice. Any statement about a particular investment or company is not an endorsement or recommendation to buy or sell any such security. The article is not intended to provide legal, accounting, financial or tax advice, and should not be relied upon in that regard. You are encouraged to seek independent advice. Every effort has been made to ensure that the article is accurate as of the date of first publication; however, we cannot guarantee that it is accurate, complete, or current at all times. The article may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

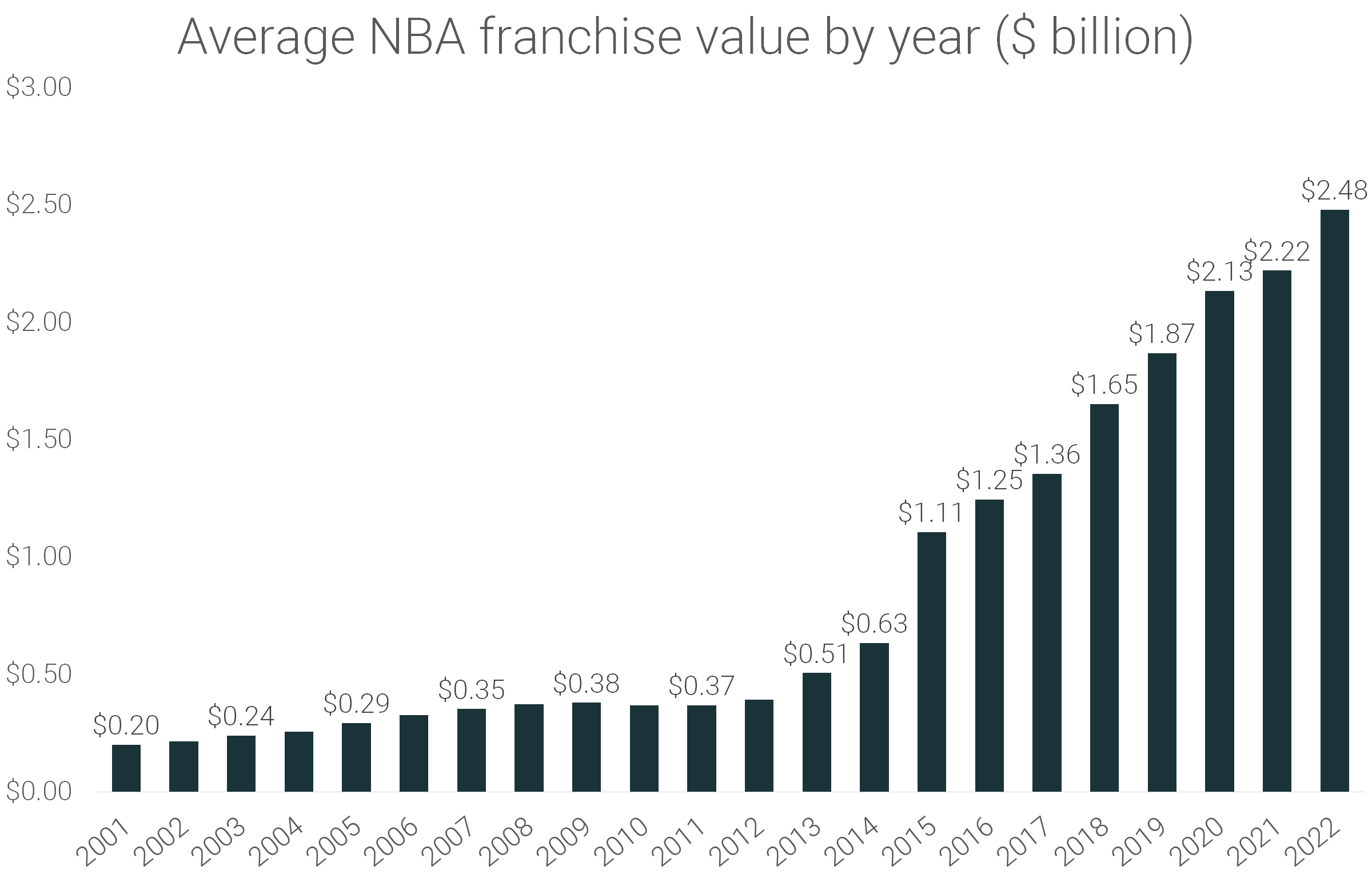

On Thursday, June 16th, 2022, the Golden State Warriors claimed their fourth NBA championship by beating the Boston Celtics. The Warriors have dominated the NBA in recent years, claiming four of the last eight NBA championships. As Steph Curry claimed his first Finals MVP award, I found my mind wandering to the money side of the NBA. It turns out the Warriors have ascended the NBA’s podium not just as repeat winners of the Larry O’Brian trophy but also as the second most valuable franchise in the league (right behind the lowly but lucrative NY Knicks). Per Forbes, the Warriors were valued at a whopping $5.6 Billion in 2022 up from $2.6 Billion five years ago, a 25% compounded annual growth rate. More amazingly, between 2002 and 2021, the average price return for an NBA team was 1,057% compared to 458% for the S&P 500, according to estimates from PitchBook (as cited by CNBC).

The NBA is one of a handful of professional sports leagues experiencing strong commercial growth on the back of increasing fan engagement and growing (and diversifying) revenue streams. It’s no surprise then that some of the world’s leading institutional investors, i.e. private equity, are increasingly interested in acquiring ownership stakes in sports franchises. In 2021, private equity investors allocated $51 Billion to acquire professional sports related assets, marking an $18 Billion year over year increase. Deals were struck for minority ownership in NBA clubs (San Antonio Spurs, Golden State Warriors), European Football (LaLiga, Liverpool Football Club) and many others (source: Pitchbook, Forbes, Sportico as cited by Bloomberg). So what the heck is private equity and why are they so interested in your favorite sports teams?

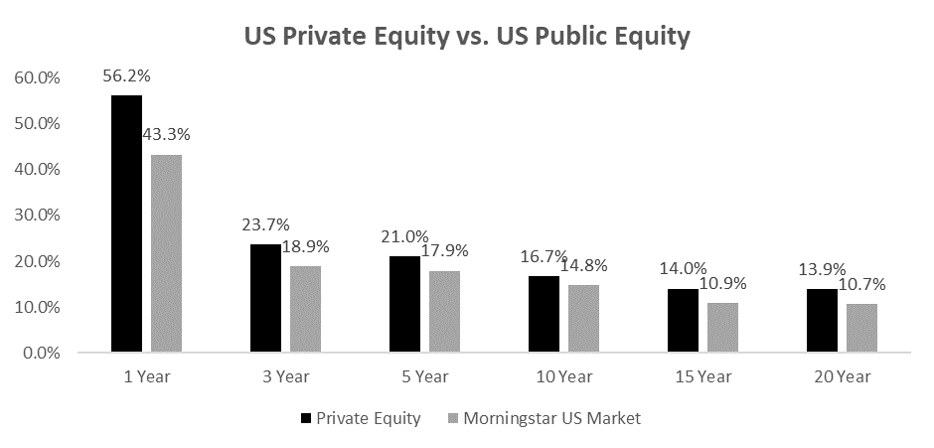

Private equity, as its name implies, is equity ownership in a private enterprise (not listed on a public stock exchange). Historically, private equity transactions took the form of buyouts where a private equity firm would acquire a target company outright, find ways to add value, and resell some/all of the acquired company at a higher value. Today, private equity transactions span a variety of structures and terms. Many retail investors may not be aware that private equity is a $6+ Trillion dollar asset class that has been generating exceptional returns for institutional investors for many decades. Retail investors may have greater familiarity with venture capital, a sub-category of private equity, that has, until very recently, been at the forefront of the growth of the private equity asset class.

Private equity investments span every sector of the economy and every region of the world. Everything from where we live, to what we eat, to what we watch, is in some way tied back to the rapidly expanding private equity sector. A 2020 research report produced by Ernst & Young and the American Investment Council highlighted that private equity backed companies directly employed more than 11.7 million workers in the United States and generated $1.4 Trillion of gross domestic product (GDP), or approximately 6.5% of total US GDP for the year.

Professional sports is the most recent industry to see a ramp up in interest and capital from private equity investors. The space showed it was resilient to economic downturns by continuing to garner significant consumer interest during the worst of the COVID-19 pandemic and continuing to see an upward movement in average team valuations even with close to no revenue from live event ticket sales. According to Forbes, the 50 most valuable professional sports teams across the world saw their values increase by 9.9% during 2020. This economic resilience combined with increasingly valuable media rights and new, highly lucrative sources of revenue coming online (legal sports gambling), make professional sports attractive stomping grounds for private equity. Private equity firms like Blue Owl, CVC, Sixth Street, RedBird, Arctos and others continue to build their sports asset portfolios, which in turn create value for their fund investors (typically large institutional and ultra-high net-worth “UHNW” investors). Unfortunately, retail investors remain largely on the sidelines when it comes to investing in private equity funds, which in turn means you can’t claim to be a part owner of your favorite sports team. This is beginning to change as private equity solutions become more accessible by regular investors, but many barriers remain.

While the Golden State Warriors fans, players and staff celebrated their 2022 NBA Championship, the folks at Arctos Sports Partners, who acquired 13% of the Warriors in 2021, were very likely celebrating just a bit harder, enjoying the likely increase in the value of their ownership stake in the NBA’s golden boys.